Solar stocks have had a great opportunity to do well lately. The combination of a shaky economy, a crumbling power grid, and a constantly rising need for energy have done a lot of good for alternative energy in general. Enphase (NASDAQ:ENPH) is no exception here, and with a new analyst getting in on the action, Enphase investors are happy, driving shares up in Monday afternoon’s trading.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Raymond James’ analyst, Pavel Molchanov, took an unlikely step recently, hiking Enphase from Hold to Buy. Further, he also established a price target of $225 per share. Previously, when he issued his Hold rating, he didn’t have a price target on the company at all. Molchanov noted that the declining price of Enphase makes it a good time to catch a falling knife. Essentially, that means buying in on a rapidly declining stock.

Molchanov elaborated on his stance, noting that Enphase is running at about 24 times per-share earnings, which is the lowest its been in around three years. But it’s not just valuation that has Molchanov so interested. It’s Enphase’s increasing diversification of revenue streams that is drawing interest. Back in 2022, 19% of Enphase’s sales came from Europe. That’s expected to hit 25% in 2023.

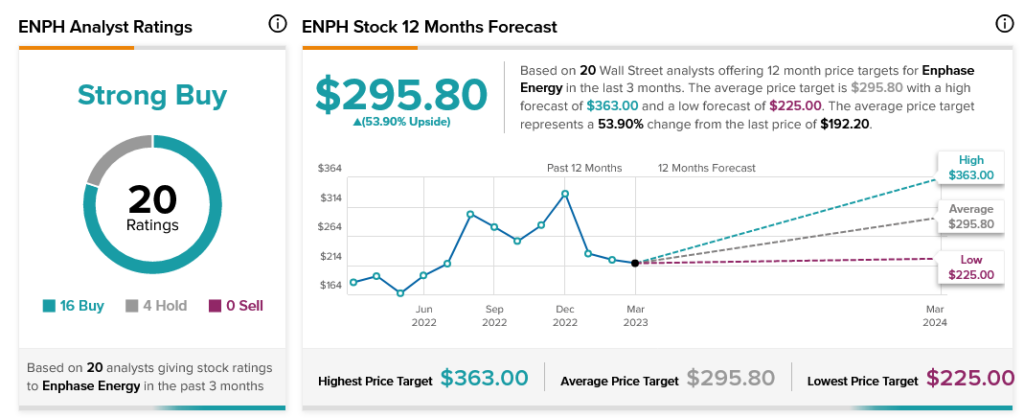

As for other analysts, they’re not too far removed from Molchanov’s stance. Currently, analyst consensus calls Enphase stock a Strong Buy by a factor of four to one. With an average price target of $295.80, it comes with 53.9% upside potential.