Social media stock Snap (NYSE:SNAP) was having a terrific run lately. I say “was” here because in a matter of minutes—with the end of Thursday’s trading session—it’s about to bring a 10-day series of wins to a halt with fractional losses.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The gains had been impressive for Snap so far; in that 10-day run of green closing, Snap added roughly 20.3% to its share price, reports note. But that doesn’t seem to be enough to stop investors from taking at least a little profit in the process.

Sadly, even with a hefty set of gains like that, it wasn’t really enough to keep a record on track. Just yesterday, Snap hit its best day since July 2022 but fell short of making a run at the record set in September 2021. In fact, Snap had a peach of a November, with gainers leading decliners by a factor of three to one, 15 sessions in the green, and five in the red.

Advertising Making a Comeback?

The reasons behind Snap’s surge aren’t exactly clear, but one potential cause bandied about frequently is a return of digital advertisers. Back on November 30, James Heaney, an analyst with Jefferies, hiked his rating on Snap from Hold to Buy, citing new interest in “direct response advertising.” That’s an ad style that allows customers to make a purchase immediately upon seeing the ad itself.

The direct response concept recently had some retooling and was likely to produce better returns. This means that ad purchases may be more likely, which is a win for all concerned. Plus, with X—formerly known as Twitter—under fire from advertisers, that could be an opportunity for Snap to step in.

Is Snap a Buy, Sell, or Hold?

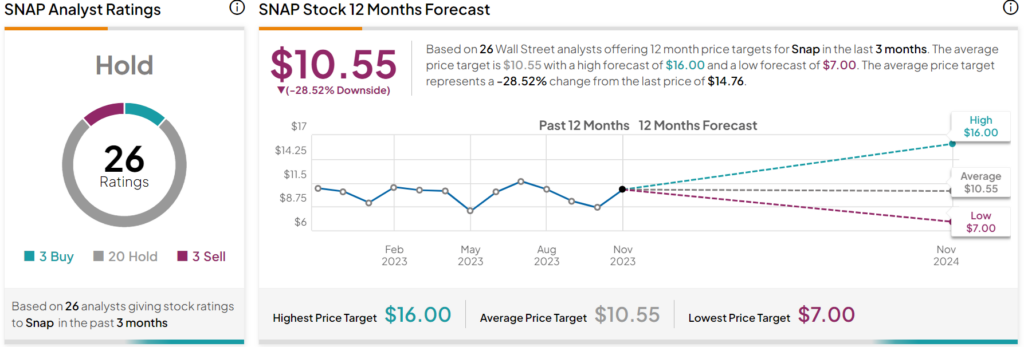

Turning to Wall Street, analysts have a Hold consensus rating on SNAP stock based on three Buys, 20 Holds, and three Sells assigned in the past three months, as indicated by the graphic below. After a 56.17% rally in its share price over the past year, the average SNAP price target of $10.55 per share implies 28.52% downside risk.