Empire Company (TSE:EMP.A), the owner of grocery chains like Sobeys and Safeway, released its Q4 and Fiscal 2023 earnings results (for the period ended May 6, 2023) earlier today while revealing a 10.6% dividend increase to a quarterly rate of C$0.1825 per share. The report was mixed, as EPS came in ahead of expectations, but revenue missed the mark. Nonetheless, EMP.A stock is rallying modestly today.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

The company’s adjusted earnings per share (EPS) came in at C$0.72 per share compared to $0.68 per share reported in Q4 2022, beating the consensus EPS estimate, which was also C$0.68. However, revenue came in at C$7.41 billion, down from C$7.84 billion last year and missing the consensus estimate of C$7.55 billion. It’s worth noting that last year’s revenue figure included an extra week.

Empire’s same-store sales, not including fuel sales, saw a rise of 2.6%, with gross margins increasing to 26.4% from 25.6% due to improved store efficiencies, decreased supply-chain costs, and the impact of lower fuel sales.

The company’s performance includes the completion of a three-year growth strategy, which included store renovations and expansions, the optimization of promotional and data analytics, and a notable enhancement of in-house food brands. This strategy, named “Project Horizon,” contributed to an incremental C$500 million in annualized EBITDA.

Empire bought back C$350 million worth of shares in Fiscal 2023 and plans to buy back another ~C$400 million worth of Class A shares in Fiscal 2024.

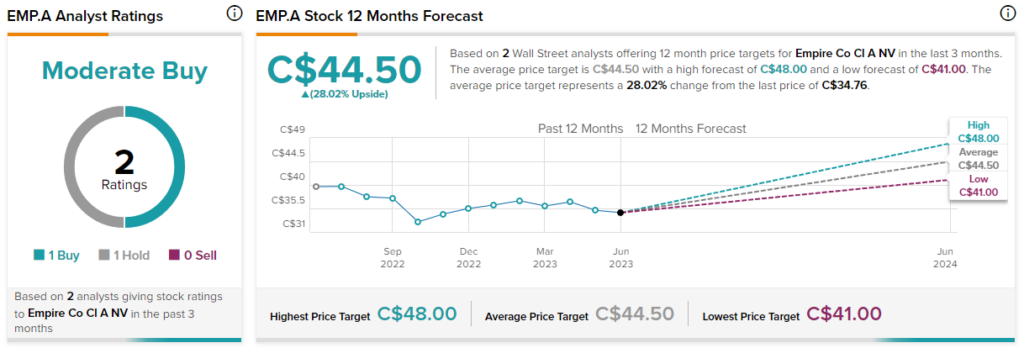

Is EMP.A Stock a Buy, According to Analysts?

According to analysts, EMP.A stock comes in as a Moderate Buy based on one Buy and one Hold rating assigned in the past three months. The average EMP.A stock price target of C$44.50 implies 28% upside potential.