New research from Goldman Sachs predicts that emerging markets’ stocks and currency will rally through the end of 2025. Indeed, emerging market stocks have rallied in the first nine months of the year, and they show no sign of slowing down.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The Goldman report explains that a weak U.S. dollar, investor interest in geographical diversification, and strong company earnings are all catalysts for emerging markets’ growth. Backed by its belief in these markets, Goldman Sachs Research has raised its forecast. It now expects the MSCI EM index to reach 1,480 over the next 12 months, reflecting growth in price returns of around 7.80%.

For context, the MSCI EM index is a benchmark index that measures the performance of large and mid-cap companies in 24 emerging market countries.

Furthermore, the Goldman Sachs report predicts that company earnings in emerging markets will grow 9% in 2025, and 14% in 2026. Stronger tech and greater demand for AI, particularly in Chinese, Taiwanese, and South Korean companies, are the key reasons for these raised earnings expectations.

Which Emerging Markets ETFs are Best?

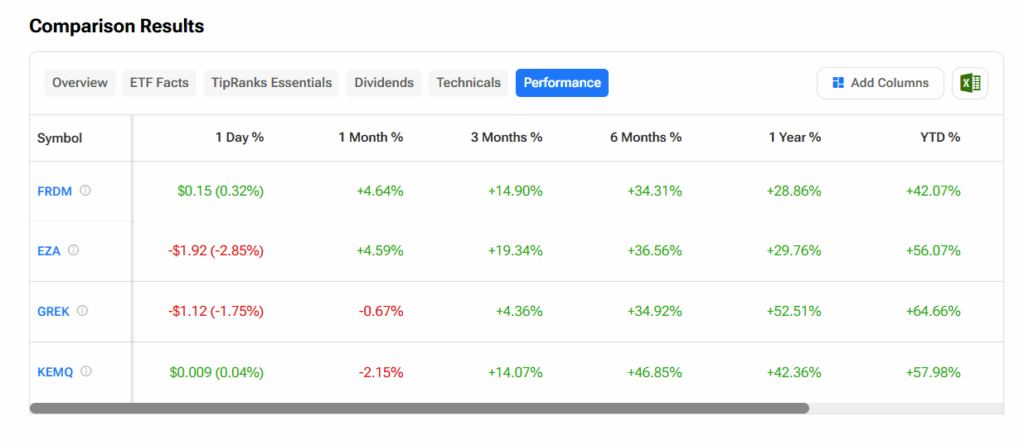

Year-to-date, multiple emerging markets ETFs have produced bumper returns. Using TipRanks’ Compare ETFs chart, we have identified the top-performing emerging markets ETFs so far in 2025.

GREK (Global X MSCI Greece ETF), which gives exposure to the Greek markets, comes out ahead, with 64.7% growth year-to-date.

KEMQ (KraneShares Emerging Markets Consumer Technology Index ETF), which offers exposure to the information technology sector of emerging markets, is next, with 58% growth year-to-date.

Right behind that is EZA (iShares MSCI South Africa ETF), providing exposure to the South African equities market. EZA has increased by 56% year-to-date.

FRDM (Freedom 100 Emerging Markets ETF) holds companies from countries that have relatively higher scores of personal and economic freedoms. The FRDM ETF has also performed robustly in 2025, showing a 42.1% increase year-to-date.

Interested in learning more? Research all ETFs at TipRanks’ ETF Center.