A jury in Texas has ruled that Elon Musk’s company X Corp (formerly known as Twitter) must pay $105 million to a Dallas-based tech firm called VidStream LLC for patent infringement. VidStream first sued in 2016, claiming that Twitter used its patented video technology without permission to support video features on Twitter, Vine, and Periscope. The jury found that X willfully violated one of VidStream’s two patents, which are designed to help users create and share videos across platforms like social media, apps, and TV. VidStream had originally asked for over $600 million in damages.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Interestingly, the patented technology allows user-generated videos to be quickly converted into the right formats for different platforms. VidStream said that Twitter used this system without a license, even though the companies once discussed working together. Those talks fell through, and VidStream argued that Twitter chose to copy its invention instead. Twitter’s lawyers denied this and said its own engineers developed a separate system. They also argued that the patents were invalid because similar technology already existed before the patents were filed.

It is worth noting that VidStream acquired the patents in 2017 after the original holder, Youtoo Technologies, went bankrupt. During the trial, VidStream’s lawyer said that Twitter knowingly took the invention rather than becoming a partner. X Corp responded by saying that it was not interested in using video for TV, which was a focus of Youtoo, and claimed that it had already built its own tools.

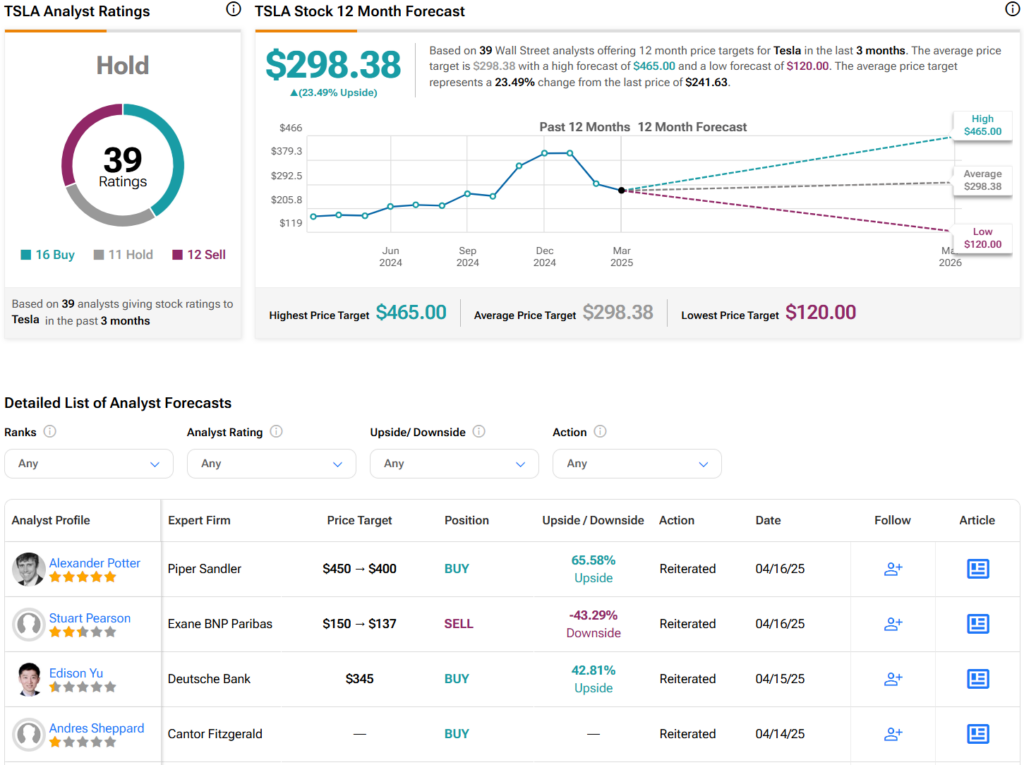

What Is the Prediction for Tesla Stock?

When it comes to Elon Musk’s companies, most of them are privately held. However, retail investors can invest in his most popular company, Tesla (TSLA). Turning to Wall Street, analysts have a Hold consensus rating on TSLA stock based on 16 Buys, 11 Holds, and 12 Sells assigned in the past three months, as indicated by the graphic below. Furthermore, the average TSLA price target of $298.38 per share implies 23.5% upside potential.