Elon Musk‘s social media platform, X (formerly Twitter), has introduced a nominal $1 annual fee for new users in New Zealand and the Philippines. The new subscription plan, named “Not a Bot” aims at combating spam and automated bot accounts on the platform.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

New users on the platform will be required to verify their phone numbers and make the payment to post content or interact with other tweets. Those who do not pay will still have access to viewing and reading posts, watching videos, and following accounts. Existing users will not be impacted by this test.

Additionally, the subscribers to X’s premium subscription service, starting at $8 per month, will remain unaffected by this change.

Efforts to Boost Top-Line

These actions can be seen as part of the platform’s strategy to boost its financial performance. After Musk took control, X faced several challenges, including a $13 billion debt and a significant decline in ad revenues as advertisers left the platform due to changes in content safety rules.

X’s CEO Linda Yaccarino is working to broaden X’s revenue streams by introducing new features that can generate income through diverse channels, like e-commerce and financial payment features.

Tesla’s Upcoming Q3 Results

As Musk tackles challenges to enhance the social media platform, investors are eagerly waiting to know the third-quarter margin performance of his electric vehicle company, Tesla (NASDAQ:TSLA). TSLA’s Q3 results are scheduled to be released after the market closes on Wednesday, October 18.

Wall Street analysts are expecting the company’s third-quarter revenue to increase 13% year-over-year to $24.3 billion. Meanwhile, they anticipate TSLA’s Q3 adjusted earnings per share (EPS) to fall by about 30% to $0.73 due to lower margins.

Is Tesla a Buy or Sell Right Now?

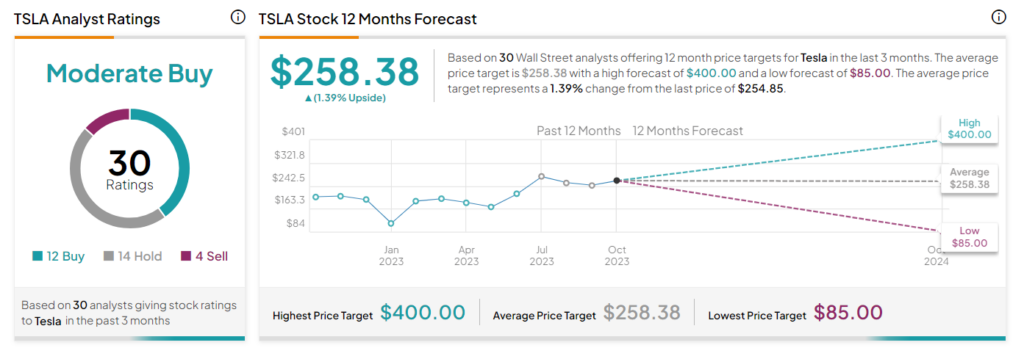

Tesla stock has received 12 Buys, 14 Holds, and four Sells for a Moderate Buy consensus rating. Analysts’ average 12-month price target of $258.38 implies a marginal upside potential of 1.39% from current levels. The stock has gained over 135% year-to-date.