Elon Musk just pulled the plug on his strangest side quest yet—and the ripple effect is already hitting Tesla’s (TSLA) orbit. On May 29, the Tesla CEO confirmed he’s stepping away from DOGE, the White House’s so-called Department of Government Efficiency, where he served as cost-cutting czar under President Trump.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

It was, in Musk’s own words, “an uphill battle.” And now, the world’s richest tinkerer says he’s done with it.

Not Exactly Mission Accomplished

DOGE, Musk’s bureaucratic side project, claimed to have slashed 260,000 federal jobs and saved $175 billion in taxpayer funds—numbers that critics say don’t hold up. But that’s not why he’s leaving.

In a blunt interview with The Washington Post, Musk admitted the entire operation was harder than he thought. “The federal bureaucracy is worse than I expected,” he said, adding that he was spending too much time on politics. He later told Ars Technica that he’s actively pulling back.

“It was just relative time allocation that probably was a little too high on the government side,” Musk said. “And I’ve reduced that significantly in recent weeks.”

Tesla Reacts—So Does the Market

That’s all Tesla investors needed to hear. After Musk confirmed he’d be winding down his DOGE duties in Tesla’s Q1 earnings call, the stock jumped over 5% in after-hours trading—even though the company posted an 80% drop in quarterly net income. The rally continued into today, with shares up another 2.5% in pre-market trading.

That reaction speaks volumes. Tesla shareholders have long worried that Musk’s political distractions—whether it’s DOGE or his various spats on X—are eating into his focus. His departure from DOGE feels like a signal: Musk’s attention is returning to the mothership.

Still in the Game, Just Not That Game

This doesn’t mean Musk is ditching politics or crypto entirely. Tesla still holds 11,509 BTC, now worth around $1.24 billion, and Musk remains a vocal force in both spheres. But the message is clear: less policy wrangling, more product focus.

DOGE may be over. But what really matters now is whether Tesla can keep growing in the long run.

Is Tesla a Buy, Sell, or Hold?

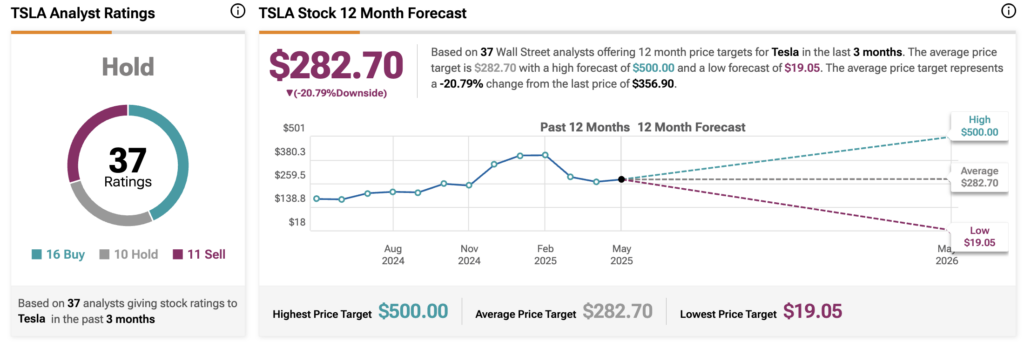

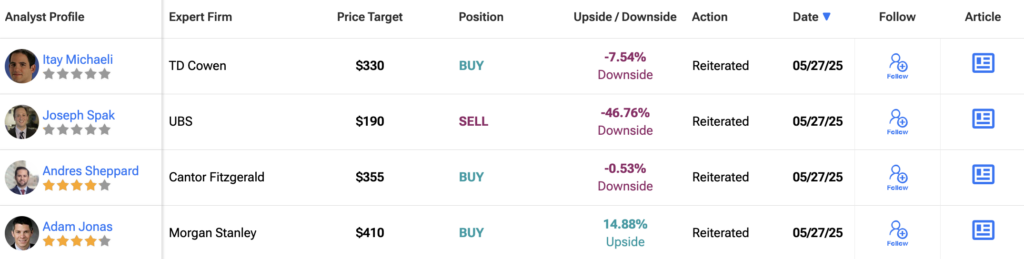

Wall Street hasn’t fully made up its mind. According to TipRanks, Tesla currently carries a “Hold” rating based on 37 analyst reviews over the last three months. The average 12-month TSLA price target sits at $282.70 — nearly 21% below where shares trade today. The spread is wide: some see a run toward $500, while others peg the downside as deep as $19.

It’s a reflection of the moment Tesla’s in — caught between big vision and big expectations. And with Musk stepping back from political distractions, the pressure’s back where investors want it: on performance.