Billionaire Elon Musk recently criticized a large Republican spending bill that passed a House vote by saying it goes against his efforts to cut government waste. In an interview that will be aired June 1 on “CBS Sunday Morning,” Musk said that the “big, beautiful bill” actually increases the budget deficit instead of shrinking it. As the head of the Department of Government Efficiency (DOGE), Musk said the bill undercuts what his team has been trying to accomplish.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Indeed, since DOGE launched in January, it claims to have saved $170 billion by targeting government waste and overlap. This has included major cuts like shrinking the U.S. Agency for International Development and laying off around 275,000 government workers, according to consulting firm Challenger, Gray & Christmas. In contrast, the new One Big Beautiful Bill Act is expected to add $3.8 trillion to the deficit over 10 years, with the 2025 deficit expected to reach nearly $2 trillion. For reference, the total U.S. national debt is already $36.2 trillion.

Musk also joked by saying, “I think a bill can be big or it could be beautiful, but I don’t know if it could be both.” Unsurprisingly, Trump and Republicans say that the bill will reduce spending in important areas and fuel enough growth to make up for the tax cuts, although it may struggle to pass the Senate. Nevertheless, Musk, who used to be very involved in the White House since Trump’s election, now says that he’s stepping back from DOGE to focus on running his companies: X, Tesla (TSLA), and SpaceX.

What Is the Prediction for Tesla Stock?

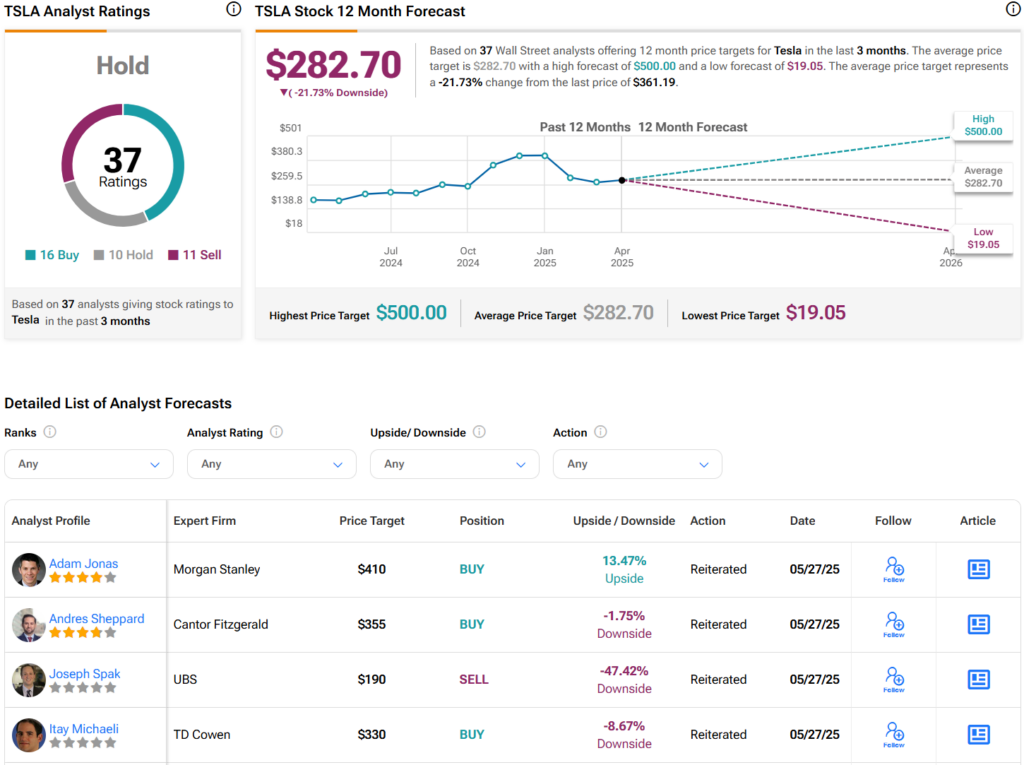

When it comes to Elon Musk’s companies, most of them are privately held. However, retail investors can invest in his most popular company, Tesla. Turning to Wall Street, analysts have a Hold consensus rating on TSLA stock based on 16 Buys, 10 Holds, and 11 Sells assigned in the past three months, as indicated by the graphic below. Furthermore, the average TSLA price target of $282.70 per share implies 21.7% downside risk.