Shares of Eli Lilly (NYSE:LLY) took a hit at the time of writing following a Journal of the American Medical Association report on its obesity drug, tirzepatide, marketed as Zepbound. The study revealed that although patients experienced an impressive average weight loss of 20.9% over 36 weeks of tirzepatide therapy, they regained 14% of their weight within a year of switching to a placebo. However, patients who continued the therapy lost an additional 5.5% of their weight.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The study, which was sponsored by Eli Lilly and involved 670 overweight adults without diabetes, highlighted the difficulties of obesity treatment and the challenges of maintaining weight loss. It also pointed out its limitations, like not adjusting doses post-randomization or considering the impact of behavioral therapy on sustained weight loss.

What is the Target Price for LLY?

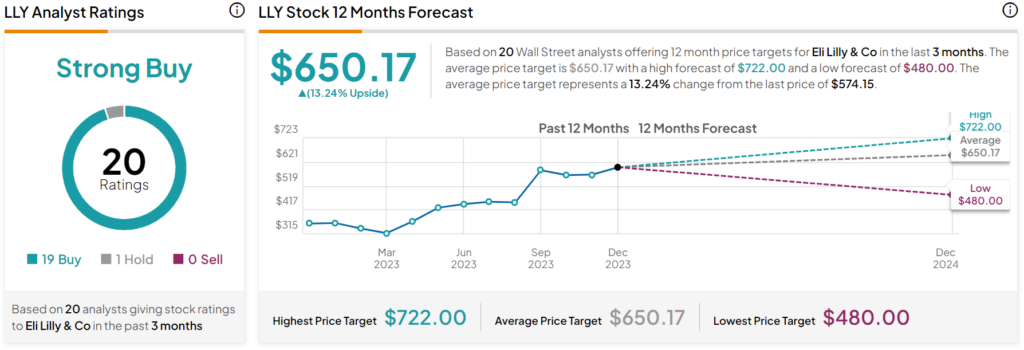

Turning to Wall Street, analysts have a Strong Buy consensus rating on LLY stock based on 19 Buys, one Hold, and zero Sells assigned in the past three months, as indicated by the graphic below. After a 58% rally in its share price over the past year, the average LLY price target of $650.17 per share implies 13.24% upside potential.