Pharmaceutical company Eli Lilly (NYSE:LLY) has been doing some great things lately with a string of drugs. And, seeing that supply is getting to be an issue, it’s made a move to ramp up production by picking up a new manufacturing facility. That news was pretty good to investors, who pushed Eli Lilly up modestly in Monday afternoon’s trading.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Lilly picked up a factory in Pleasant Prairie, Wisconsin, from Nexus Pharmaceuticals. The new facility will focus on improving the production of its injectable drug line. Currently, there’s huge new demand for Mounjaro and Zepbound, treatments for diabetes and weight loss, and the Pleasant Prairie plant should prove especially pleasant for Lilly and its investors.

Since the plant doesn’t yet offer contract manufacturing, it should be devoted entirely to Lilly’s product line, helping it rise to meet growing demand.

Competition Mounting

It’s not a surprise, given the condition of the market right now, that anyone who has a “weight loss drug” in their arsenal is going to bring it out and work it for all it’s worth. In fact, one new startup, Metsera, is looking to get into that action itself with a “broad portfolio” of weight loss treatments. However, Lilly still has a clear advantage here: name recognition.

People know and understand the Lilly brand and will likely stick with it over a newcomer in the field…as long as it’s actually available. So, for Lilly to step up production now is a very smart move, both to meet its current demand and to deny rivals access to market share.

Is Eli Lilly a Good Stock to Buy?

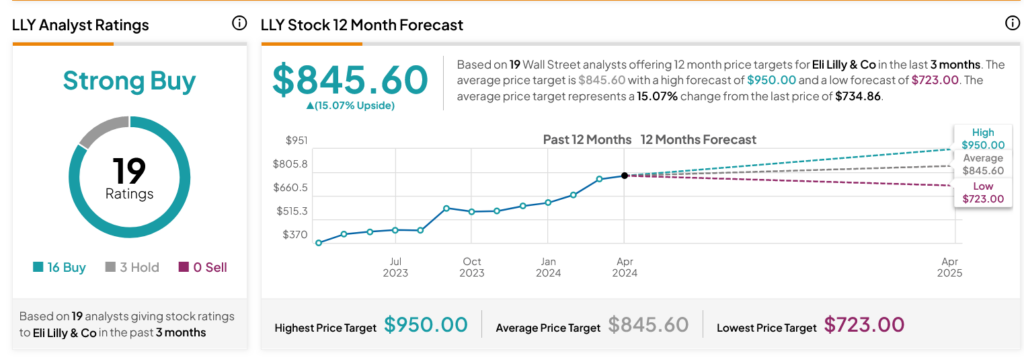

Turning to Wall Street, analysts have a Strong Buy consensus rating on LLY stock based on 16 Buys and three Holds assigned in the past three months, as indicated by the graphic below. After a 92.34% rally in its share price over the past year, the average LLY price target of $845.60 per share implies 15.07% upside potential.

Is It Wise to Allocate $1,000 Toward LLY Stock Right Now?

Before you hurry to invest in LLY, think about the following:

TipRanks’ team has built the Top Stocks Portfolio for investors, and Eli Lilly is not included. Our portfolio highlights companies that have been hand-picked for their potential to deliver significant gains in the years ahead.

See The Stocks >>