Healthcare major Eli Lilly’s (NYSE:LLY) third-quarter EPS of $0.10 came in ahead of expectations by $0.28. In sync, revenue of $9.49 billion outperformed estimates by $520 million. This was a nearly 36.7% year-over-year jump in the company’s top line.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The rise in the company’s revenue was primarily due to higher sales of Mounjaro, Verzenio, and Jardiance, alongside a $1.42 billion contribution from the sale of rights for Lilly’s olanzapine portfolio. Importantly, the company’s top line received a boost from higher pricing and volume, and its growth products revenue rose by 12% to $4.96 billion.

Lilly’s gross margin ticked higher by 42% to $7.64 billion in Q3. Additionally, the company has completed the acquisitions of DICE Therapeutics, Versanis Bio, Emergence Therapeutics, and Sigilon Therapeutics. Further, Lilly’s recently announced acquisition of POINT Biopharma (NASDAQ:PNT) is expected to bolster the company’s oncology capabilities in radioligand therapies.

Despite this performance, LLY lowered its EPS outlook for Fiscal year 2023 to the range of $6.50 to $6.70 from the previous outlook in the range of $9.70 to $9.90. The company reaffirmed its revenue expectations of between $33.4 billion and $33.9 billion.

How High Will Eli Lilly Stock Go?

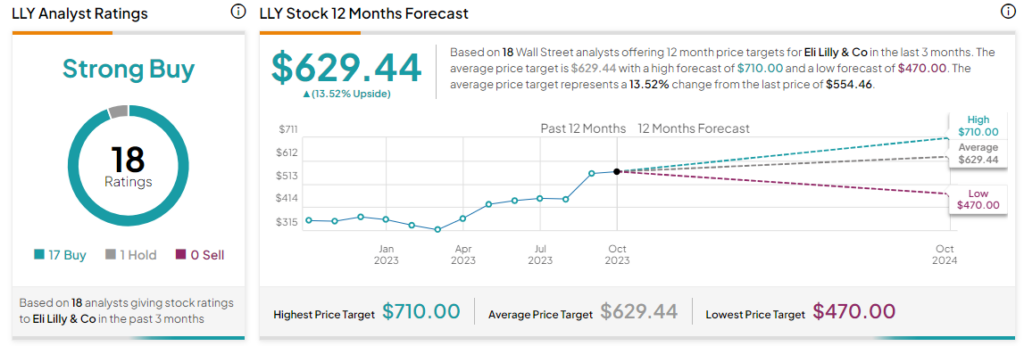

Overall, the Street has a Strong Buy consensus rating on Eli Lilly. The average LLY price target of $629.44 implies a modest 13.5% potential upside. That’s after a nearly 57% surge in LLY shares over the past year.

Read full Disclosure