Shares of health benefits services provider Elevance Health (NYSE:ELV) are on the rise today after the company posted better-than-anticipated second-quarter numbers while also taking its financial outlook a notch higher.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Revenue rose 12.7% year-over-year to $43.37 billion, comfortably scaling past expectations by $1.88 billion. EPS at $9.04 too handily beat estimates by $0.25. At the end of June 2023, medical membership stood at nearly 48 million, clocking a gain of 2% over the prior year. The rise in the top line was attributable to higher premium rates in the Health benefits vertical alongside increased premium revenue in Medicaid and Medicare.

In Q2, the benefit expense ratio dropped by 70 basis points to 86.4% owing to premium rate adjustments. Elevance has also declared a dividend of $1.48 for the third quarter. The dividend is payable on September 22 to investors of record on September 8.

Moreover, buoyed by the robust business momentum, Elevance now expects EPS for the year to be higher than $32.85 versus prior expectations of $32.70. In comparison, analysts’ estimates for the year stand at $32.74.

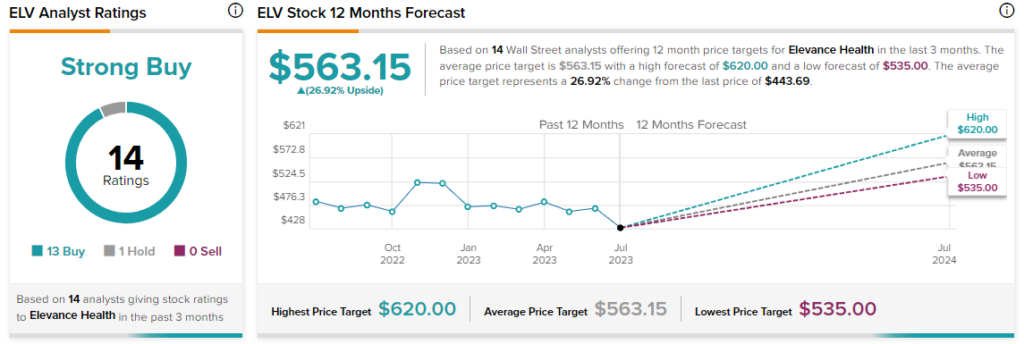

Overall, the Street has a $563.15 consensus price target on Elevance alongside a Strong Buy consensus rating.

Read full Disclosure