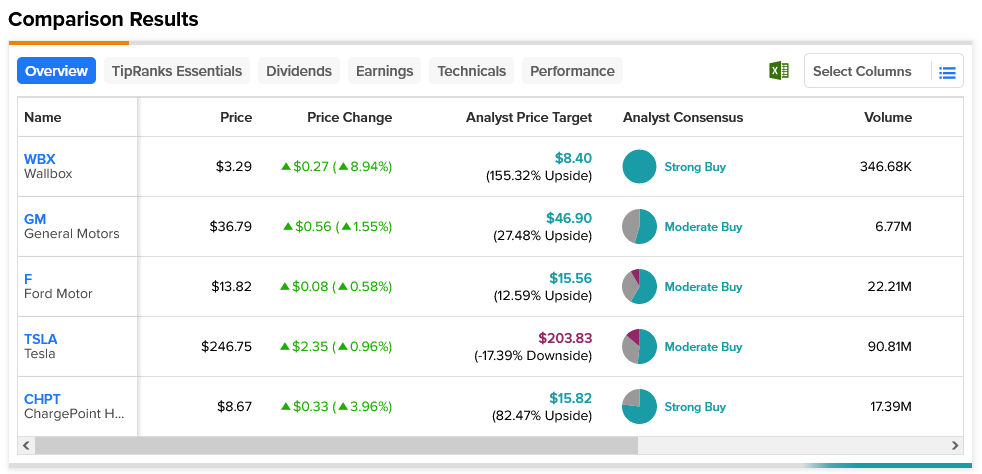

It’s been an electrifying day so far for electric vehicle stocks. Five of the leaders in the sector are all turning upward, some much so than others. Charging plays like Wallbox (NYSE:WBX) and ChargePoint Holdings (NASDAQ:CHPT) are up, as are Tesla (NASDAQ:TSLA) and two comparative newcomers to electric, legacy automakers Ford (NYSE:F) and General Motors (NYSE:GM).

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Wallbox has had the best day so far, up close to 9% at one point in Monday afternoon’s trading. The biggest reason for Wallbox’s impressive surge is that it announced it planned to add Tesla’s North American Charging Standard (NACS) connectors to its line of fast charging tools known as the Supernova line. Wallbox plans to make itself a major name in the charging game, and as such, making sure its systems were compatible with the NACS protocol was a great way to get there.

Meanwhile, Tesla’s move to allow both Ford and General Motors to connect to its Supercharger network is set to be one huge help. Colin Langan, an analyst with Wells Fargo, noted that the move will be helpful—especially with around four million GM and Ford electric vehicles on the road projected to hit sometime in 2027—but perhaps not as helpful as some investors hope. Plus, with the Freewire charging network both commending Ford and GM for the move and announcing plans to put NACS into its own operations, the key takeaway here is that NACS is really in line to be the standard.

Wallbox was indeed the big winner today and on several fronts. It’s only one of two Strong Buys by analyst reckoning—ChargePoint is the second—and it’s also got the highest upside potential. With an average price target of $8.40, Wallbox stock offers investors a 155.32% upside potential. In fact, only one of these five has a downside: Moderate Buy Tesla. Tesla stock comes with a 17.39% downside risk thanks to its average price target of $203.83.