Shares of urban air mobility company EHang (NASDAQ:EH) jumped nearly 6% today after its third-quarter revenue increased by 248% year-over-year to $3.9 million. Additionally, its net loss per American Depository Share (ADS) narrowed to RMB 0.50 from RMB 0.96 in the year-ago period.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

During the quarter, EHang sold 13 EH216 series units, compared to 4 units in the year-ago period. The company’s gross margin improved by 4.4% sequentially to 64.6% due to a higher average selling price for its EH216 series products.

Further, EHang’s EH216-S passenger-carrying unmanned aerial vehicle (UAV) has qualified for commercial operations in China, and the first batch of UAVs are expected to roll off the production line in the fourth quarter. Recently, the company partnered with the Hefei Municipal Government to introduce regular UAV operations in the city.

In addition, EHang has announced the opening of an unmanned eVTOL aircraft center in Spain. For the upcoming quarter, EHang expects revenue of RMB 56 million. Impressively, revenue for the full year is anticipated to rise by 166% to RMB 118 million.

What is the Price Prediction for EH?

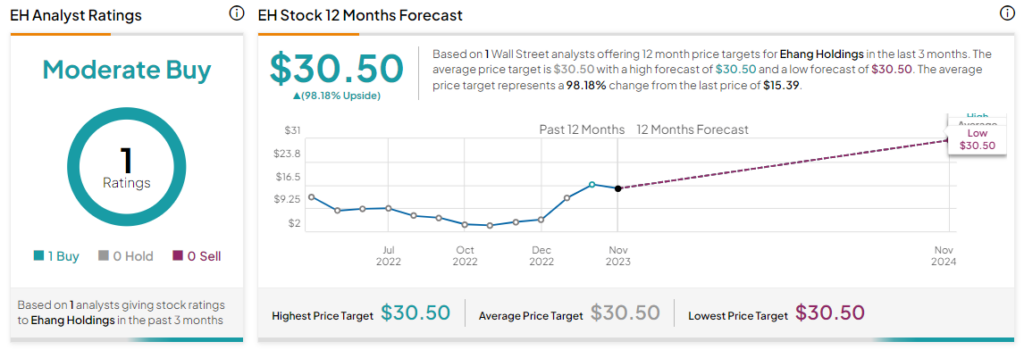

Goldman Sachs’ Allen Chang, the sole analyst tracking EHang, has a Buy rating on the stock. Following a 222% price surge in the company’s shares over the past year, Chang’s EH price target of $30.50 implies a further 98.2% potential upside.

Read full Disclosure