Shares of Chinese urban air mobility (UAM) company, EHang (NASDAQ:EH), tanked nearly 14% in the morning session today after Hindenburg Research raised questions over the company’s order book and sales figures in a new short report.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Despite sagging sales and a history of losses over the past few years, EHang’s share price has soared by over 200% in the past year. The company brought in roughly $6.5 million in revenue last year.

However, Hindenburg has cast doubts over EHang’s 1,300+ unit preorder book, citing dead or abandoned deals, failed partnerships, and customer entities with virtually no operational history. Further, Hindenburg noted that EHang’s aircraft design certification win from the Chinese government comes with multiple flight restrictions, making the majority of potential commercial use cases for the company’s eVTOL aircraft unfeasible.

Moreover, the company’s largest pre-order of 1,000 units comes from one of its pre-IPO investors, who “quietly” offloaded their entire stake in EHang in February 2021. Finally, Hindenburg highlighted that instead of collecting the “suspect” revenue, EHang has been aggressively impairing its receivables since 2020 and the company “is a fatal accident waiting to happen, both for investors and for passengers.”

What is the Price Prediction for EH?

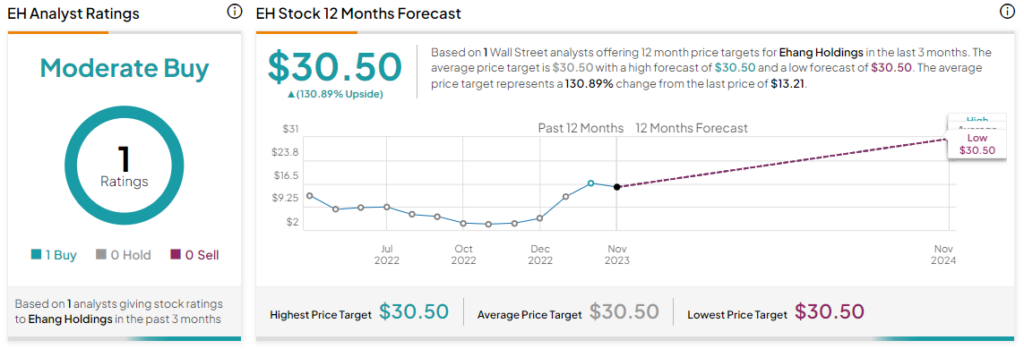

Goldman Sachs’ Allen Chang, the lone analyst tracking EHang, has recently raised the rating on the stock to a Buy from a Hold. Chang’s EH price target of $30.50 points to a massive 130.9% potential upside in the stock.

Read full Disclosure