Eaton Corporation plc (ETN), a power management company, has reported disappointing financial results for the fourth quarter of 2021, as earnings meet but sales miss estimates.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The company provides electrical and industrial components, wiring devices, residential, fire detection, lighting products. It also designs and manufactures power train systems and other components for commercial vehicle markets.

Adjusted earnings per share (EPS) increased 19% year-over-year to $1.75, in line with the Street’s estimate. Sales grew 2% year-over-year to $4.8 billion, however, fell short of analysts’ expectations of $4.91 billion.

Sales for the Electrical Americas segment climbed 13% year-over-year to $1.9 billion due to robust order activity, particularly in the residential and data center markets. The Electrical Global segment’s sales rose 14% to $1.4 billion and sales of the Aerospace segment jumped 40% to $759 million.

The Vehicle segment’s sales totaled $610 million, reflecting a year-over-year decline of 2%, while eMobility segment sales went up 4% to $88 million.

For 2021, Eaton has reported adjusted earnings of $6.62 per share, up 35% from 2020. Also, sales increased 10% year-over-year to $19.6 billion.

Outlook

The company expects adjusted EPS to range from $7.30 to $7.70 in 2022, up 13% at the midpoint over 2021. Moreover, it projects organic growth of 7% to 9%. For the first quarter of 2022, Eaton anticipates organic growth of 7% to 9% and adjusted EPS between $1.55 and $1.65.

Stock Rating

Following the results, Robert W. Baird analyst Mircea Dobre maintained a Hold rating on Eaton with a price target of $167 (10.6% upside potential from current levels).

The analyst is of the opinion that the fourth-quarter results benefitted from strong orders data, which was offset by supply chain issues, which remain a hurdle for Eaton. Dobre noted “conservativism in Electrical given strong order intake, which is expected to get more aggressive as he gains comfort with Eaton’s ability to ramp its own production and boost earnings growth relative to peers.”

Overall, the stock has a Moderate Buy consensus rating based on 3 Buys and 3 Holds. The average Eaton price target of $181 implies 19.9% upside potential. Shares have gained 21.4% over the past year.

Positive Sentiment

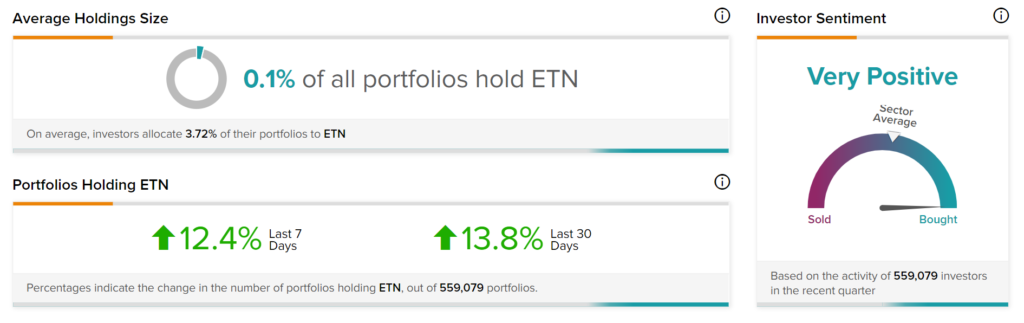

TipRanks’ Stock Investors tool shows that investors currently have a Very Positive stance on Eaton with 13.8% of investors increasing their exposure to ETN stock over the past 30 days.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

Unity Soars 15.1% on Stronger-Than-Expected Q4 Results

Lumentum Declines 14% on Poor Q3 Guidance

Regeneron Posts Upbeat Q4 Results