Technology-based materials and solutions provider DuPont (NYSE:DD) is nearing a deal to sell its Delrin resins unit to the private equity firm The Jordan Company, Bloomberg reported. Per the report, the divestiture of Delrin may deliver $1.8 billion to DuPont, and a transaction could be announced as soon as this week.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Besides for The Jordan Company, Lone Star and Platinum Equity are other bidders for Delrin.

DuPont is transforming its operations to focus on the electronics, healthcare, aerospace, industrial technologies, protection, water, and next-gen automotive sectors. In February 2022, the company announced the divestiture of most of its Mobility & Materials segment to Celanese Corporation (NYSE:CE). In addition, DuPont stated that it is advancing the process to divest the Delrin business.

DuPont presents the Delrin divestiture as discontinued operations and anticipates closing the sale by the end of 2023. Further, the company is using the funds from earlier divestitures to repurchase shares and fund acquisitions. While DD is transforming its business to emerge as a multi-industrial company, let’s look at what the Wall Street analysts recommend for the stock.

Is DuPont Stock a Good Buy?

The lower volumes in consumer-facing markets like consumer electronics and semiconductors have adversely impacted the company’s performance in the first half of 2023. However, in the longer term, the AI (artificial intelligence) revolution will likely drive DD’s financials as the company offers leading materials that support the manufacturing and packaging of next-gen advanced chips.

Additionally, the company’s presence in the desalination and wastewater markets is consistently expanding. Also, its automotive adhesive business is poised to benefit from the growing adoption of EVs (electric vehicles).

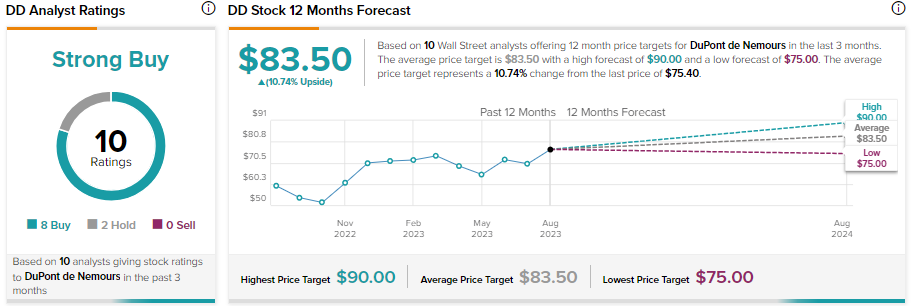

Thanks to the solid long-term growth opportunities, eight out of 10 analysts covering DuPont stock have rated it a Buy. The stock has a Strong Buy consensus rating on TipRanks. DuPont stock has gained about 11.5% year-to-date, and analysts’ average price target of $83.50 implies an upside potential of 10.74% from current levels.