Shares of Duolingo (NASDAQ:DUOL) gained more than 9% on Wednesday’s extended trade. The upside can be attributed to the company beating third-quarter results by a wide margin and raising the 2023 outlook. The upbeat performance was driven by robust growth in bookings and active users.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

DUOL is a language education company that provides language learning tools and services.

Results in Detail

Duolingo reported earnings of $0.06 per share in the third quarter, which handily surpassed the analysts’ expectations of a loss of $0.07. Further, the reported figure compares favorably with a loss of $0.46 per share in the prior year’s quarter.

Similarly, total revenues climbed 43% year-over-year to $138 million and exceeded the consensus estimate of $132 million. Higher revenues across all product categories contributed to Duolingo’s top-line growth.

Delving deeper into the revenue components, Subscription revenue, comprising about 77% of revenues, rose 47% from the same quarter last year. Moreover, DUOL ended Q3 with paid subscribers of about 5.8 million, up 60%. In addition, advertising revenue was also up 10% to $11.7 million, while Duolingo English Test income climbed 30% to $10.6 million.

It is worth mentioning that Duolingo witnessed strong growth in monthly active users (MAUs) and Daily active users (DAUs) during the quarter. MAUs grew 47% to 83.1 million, while DAUs rose 63% to 24.2 million from the prior-year quarter.

Upbeat Outlook

For the fourth quarter of 2023, Duolingo is projecting total bookings of between $167 million and $170 million. Revenue is expected to range between $145 million and $148 million.

Duolingo boosted its financial projections for the full year 2023. Total bookings are expected to reach between $598 million and $601 million, surpassing the previous forecast of $569 million to $575 million. Meanwhile, revenues are projected to fall in the range of $525 million to $528 million, exceeding the earlier guidance of $510 million to $516 million.

Is DUOL a Good Stock to Buy?

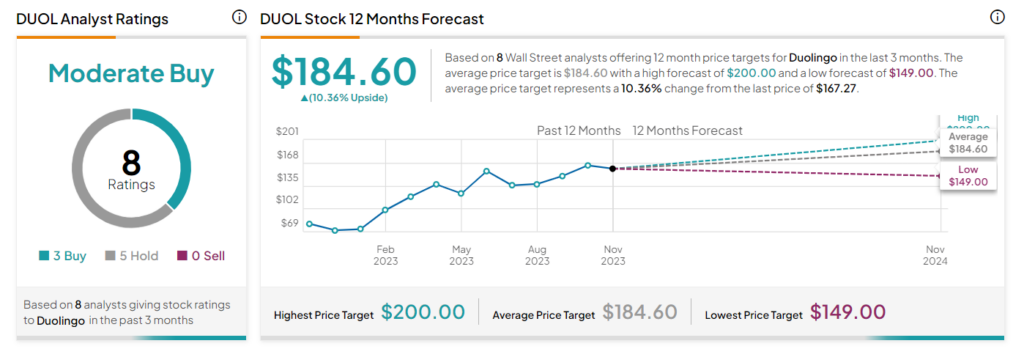

Duolingo is poised for continued upward growth with support from expansion into new subject areas and a robust user base. Overall, Wall Street analysts are cautiously optimistic about DUOL stock.

On TipRanks, the stock’s Moderate Buy consensus rating is based on three Buy and five Hold recommendations. The average Duolingo stock price target of $184.60 implies an upside potential of 10.4% from the current level. Shares of the company have gained 135.8% year-to-date.