International Business Machines (NYSE: IBM) has reported excellent results for the second quarter of 2022. Adjusted earnings grew 43% year-over-year to $2.31 per share, beating the Street’s estimate of $2.27 per share.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Revenues increased 9% to $15.5 billion, driven by demand for the company’s AI (artificial intelligence) and hybrid cloud products. Software revenues grew 6.4% to $6.2 billion; Consulting revenues totaled $4.8 billion, up 9.8%, and Infrastructure revenues rose 19% to $4.2 billion. However, Financing revenues declined almost 30% to $100 million.

The Chairman and CEO of IBM, Arvind Krishna, said, “With our first half results, we continue to expect full-year revenue growth at the high end of our mid-single digit model.”

The New York-based tech giant ended the quarter with cash in hand of $7.8 billion and $50.3 billion in debt.

Wall Street’s Take on IBM Stock

Ahead of IBM’s second-quarter results, Morgan Stanley (NYSE: MS) analyst Erik Woodring maintained a Buy rating on the stock with a price target of $157 (13.7% upside potential).

IBM is one of Woodring’s favorite stocks “with less risk of downward estimate revisions than other enterprise plays. That’s because more than 50% of revenue is recurring, and the company has exposure to secularly growing areas of IT.”

On TipRanks, the stock has a Moderate Buy consensus rating based on five Buys and four Holds. IBM’s average price target of $151.89 reflects upside potential of 10% from current levels. Shares of the company have grown 10.1% over the past year.

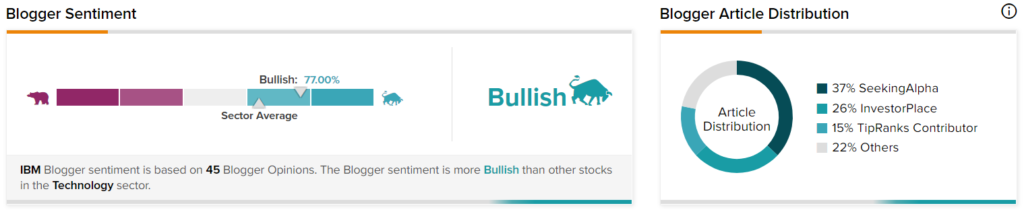

Bloggers Are Bullish on IBM

TipRanks data shows that financial bloggers are 77% Bullish on the stock, compared to the sector average of 64%.

Concluding Thoughts

Following the announcement of the results on Monday, IBM stock lost 4.3% in after-hours trading to end the day at $132.16. Technology is one of the sectors that gained the most from the COVID-19 pandemic. However, supply chain issues and inflation pressures are hurting tech firms’ revenues, which saw a multi-fold increase during the pandemic.

Read full Disclosure