DRI Healthcare Trust (TSE:DHT.UN), a pharmaceutical royalties company, has announced an agreement to purchase a royalty interest in the drug VONJO (also known as pacritinib) from S*Bio Pte Ltd. The deal, valued at US$66 million, involves an oral treatment specifically approved by the U.S. Food and Drug Administration for patients suffering from severe thrombocytopenia affected by myelofibrosis. As the sole treatment option for this condition, VONJO holds a unique market position.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

This transaction represents the second royalty acquisition DRI has completed within a month. Consequently, the firm feels more confident in reaching its deployment target of US$850-$900 million by the end of 2025.

Under the deal’s terms, DRI Healthcare is entitled to receive quarterly royalty payments based on VONJO’s worldwide net sales from April 2023 onwards. Furthermore, this agreement has the potential to provide DRI up to US$107.5 million in milestone payments.

With the new acquisition and previous transactions, DRI projects that its income growth rate will reach the high end of its 7%-9% forecast through 2025. Further, total income is now expected to be “flat to slightly growing” through 2030, not considering any future acquisitions.

Is DRI Healthcare Stock a Buy, According to Analysts?

According to analysts, DHT.UN stock comes in as a Strong Buy based on three unanimous Buys assigned in the past three months. The average DHT.UN stock price target of C$18.51 implies 66.5% upside potential.

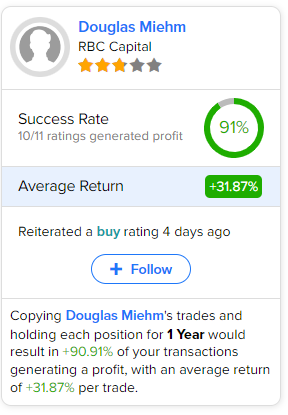

If you’re wondering which analyst you should follow if you want to buy and sell DRI Healthcare stock, the most profitable analyst covering the stock (on a one-year timeframe) is Douglas Miehm of RBC Capital, with an average return of 31.87% per rating and a 91% success rate. Click the image below to learn more.