Shares of DraftKings (NASDAQ: DKNG) surged in morning trading on Monday after top-rated UBS analyst Robin M. Farley upgraded the online betting company to a Buy from a Hold and shrugged off any valuation concerns as the stock has rallied by more than 100% year-to-date.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Farley has a price target of $30 on the stock implying an upside potential of 15.2% at current levels. The analyst commented, “Investors may wonder if the stock is expensive given that DKNG is now up +112% YTD, but we believe further upside is possible given the faster ramp in new states.”

The analyst has forecast DKNG’s revenues to grow at a compounded annual growth rate (CAGR) of more than 20% from 2023 to 2026 driven by a high growth within existing user usage on the platform. In addition, Farley expects that DKNG’s gross margin could be as high as 40% in 2024 following cost rationalization and leveraging benefits.

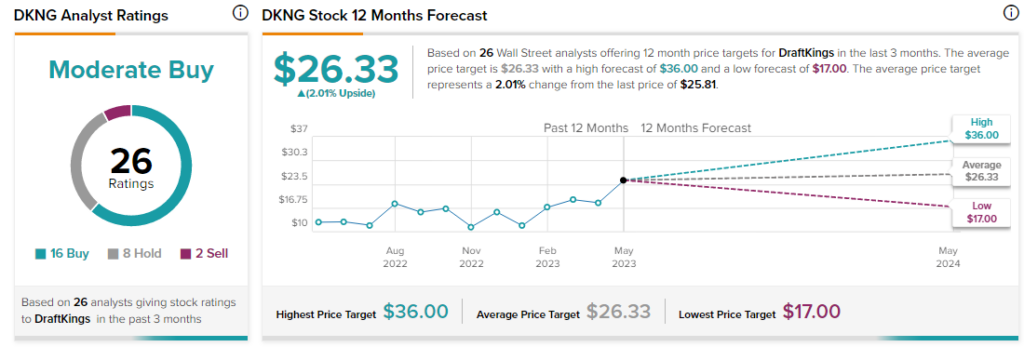

Analysts are cautiously optimistic about DKNG stock with a Moderate Buy consensus rating based on 16 Buys, eight Holds, and two Sells.