Shares of DraftKings (NASDAQ:DKNG) are slightly lower today at the time of writing following Friday’s strong rally as analysts debate their stance on the stock. Piper Sandler and Jefferies are among those in the bullish camp. Piper Sandler raised its price target on DraftKings from $25 to $30, while Jefferies sees the company’s strong earnings as evidence that the sports betting industry is more resistant to macroeconomic challenges than other consumer discretionary sectors.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Analyst David Katz notes that DraftKings’ impressive top and bottom line performance, coupled with decreasing capital requirements, brings profitability and cash flows closer than anticipated. Jefferies maintains a Buy rating on DraftKings. Key factors contributing to DraftKings’ positive outlook include a 400 basis point increase in sports betting revenue market share from last year and the company’s leading iGaming market share at 26%. In addition, DraftKings is expected to generate a positive adjusted EBITDA of $152M in FY24.

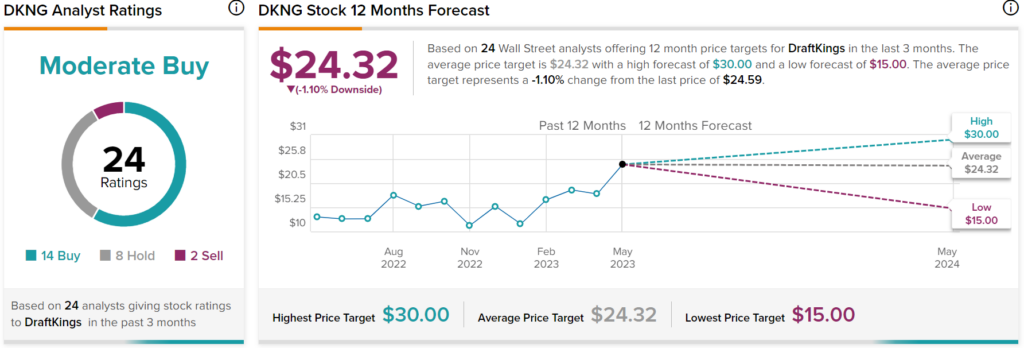

However, Roth MKM reiterated its Sell rating. Analyst Edward Engel warns of disappointing revenue and EBITDA in 2024-25 due to minimal share gains, few new state launches, and stagnant industry handle in most states. CFRA also downgraded DraftKings to Hold from Buy.

Overall, DKNG stock has a Moderate Buy consensus rating based on 14 Buys, eight Holds, and two Sells assigned in the past three months.