When DraftKings (NASDAQ:DKNG) brought out its earnings on Thursday, things looked good. Share prices were up thanks to a combination of solid earnings and a positive outlook. As a result, investors are pouring into the stock, as it’s up significantly in Friday afternoon trading.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The earnings report offered plenty of wins. Perhaps the biggest of these was that DraftKings should produce a positive EBITDA before the end of 2024. Then there was the issue of DraftKings’ web traffic. Website growth was sufficient to suggest top-line sales growth—which arrived—and further growth is expected from there. Then, the analysts started kicking in. BTIG’s Clark Lampen put an upgrade on DraftKings that sent it from Hold to Buy.

Lampen noted that he expected “…DraftKings to consolidate a leading position in OSB, and the added flexibility to invest elsewhere should allow it to be more competitive going forward…” Lampen wasn’t alone, either; Bernie McTernan at Needham reiterated a Buy rating just yesterday, as did Mike Hickey with Benchmark. It certainly doesn’t hurt that DraftKings proved to be the most-downloaded sportsbook app for the Super Bowl, either. Given that customers seemed particularly happy with DraftKings’ parlay operations, they should stick around.

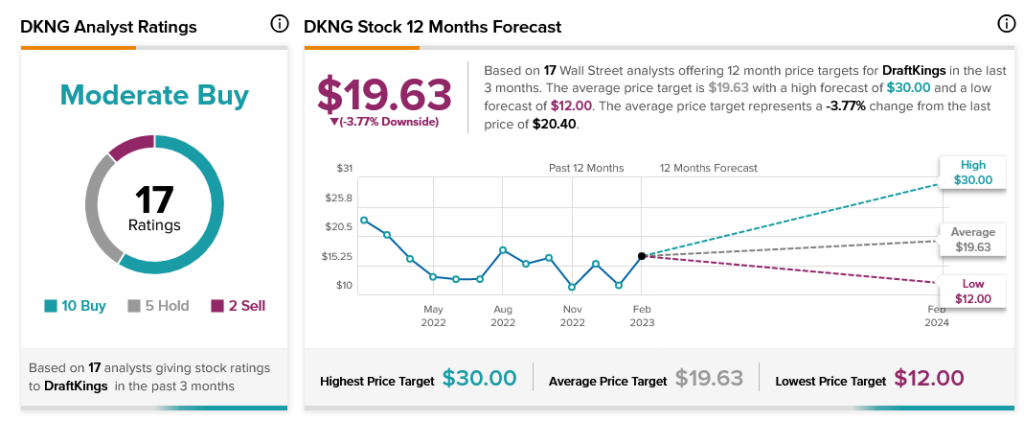

Although Wall Street isn’t completely convinced, it seems to be coming around. Current analyst consensus calls DraftKings stock a Moderate Buy. However, an average price target of $19.63 implies 3.77% downside risk.