Dow Chemicals (NYSE:DOW) recently dropped its earnings report, and investors weren’t happy, as the stock is down slightly in Thursday afternoon trading. However, Dow’s plan to turn things around may be welcome news, though not for everyone. Especially for former employees.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Dow’s earnings report left plenty to be desired. It turned in earnings per share of $0.46, which missed analysts’ consensus projections of $0.57 per share. Net sales, meanwhile, came in at $11.9 billion, which was not only down 16% sequentially, it was also 17% lower than 2021’s figure. A strong dollar and customers no longer stocking up on cleaning supplies also didn’t help Dow much. In turn, this prompted Dow to reveal an arsenal of cost-savings measures, including “optimizing labor and services costs.” That’s another way of saying “firing 2,000 people.”

That’s got some outside analysts deeply concerned. The firestorm of layoffs roaring through technology companies right now was bad enough, though people are used to tech sector hiring volatility. Layoffs at Dow, however, suggest a much darker term: systemic. If layoffs are starting up throughout the business world, that puts the potential of larger inflation into play, and that could mean a lot more trouble for a lot more stocks to come.

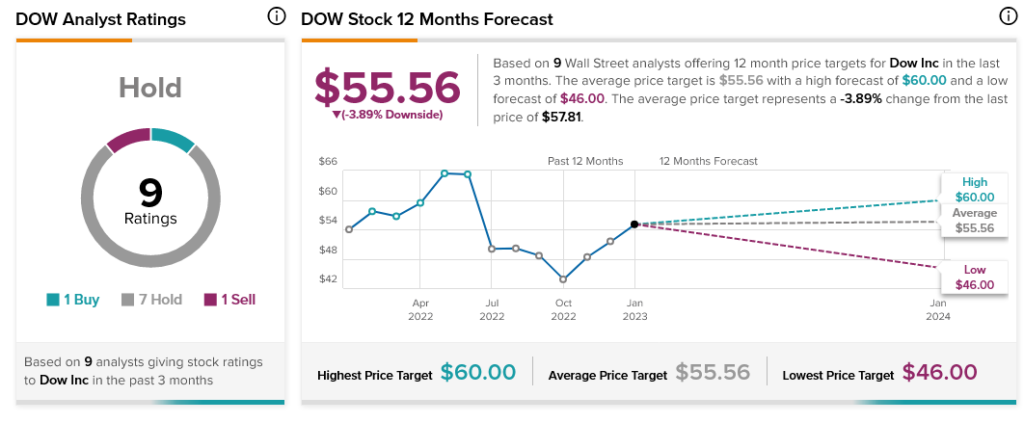

Meanwhile, Wall Street is largely sitting out on DOW stock, as analyst consensus calls it a Hold. Worse yet, Dow stock also has 3.89% downside risk thanks to its average price target of $55.56 per share.