DoorDash (DASH) reported first-quarter results that showed huge improvements from a year ago. It also issued an upbeat outlook for the second-quarter and full-year 2021. DoorDash stock jumped 21.68% on Friday.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Founded in 2013 and based in San Francisco, DoorDash provides online food ordering and delivery services. It operates in all the U.S. states and also has a footprint in Canada and Australia.

The company reported revenue of $1.1 billion, representing an increase of 198% year-over-year. That was supported by a 222% increase in marketplace gross order volume (Marketplace GOV) to $9.9 billion. Gross profit rose to $493 million from $148 million a year ago. Net loss narrowed to $110 million from $129 million.

“We are proud of the progress we made in Q1, as we increased the number of partner merchants we support across multiple categories, generated more earnings for more Dashers than in any previous quarter, and served more consumers than we ever have,” DoorDash CEO Tony Xu and CFO Prabir Adarkar said in a statement.

DoorDash forecast Q2 Marketplace GOV in the range of $9.4 – $9.9 billion. It expects up to $100 million in adjusted EBITDA. For full-year 2021, the company guided Marketplace GOV to be in the range of $35 billion – $38 billion. It expects up to $300 million in adjusted EBITDA. (See DoorDash stock analysis on TipRanks)

On the back of DoorDash’s Q1 results, Needham analyst Bernie McTernan reiterated a Buy rating with a price target of $175 on the stock. McTernan’s price target indicates 24.05% upside potential.

“We believe that DASH can leverage its leadership position in restaurant delivery to become one of the leading, horizontal, on-demand, last-mile fulfillment providers in North America,” noted McTernan.

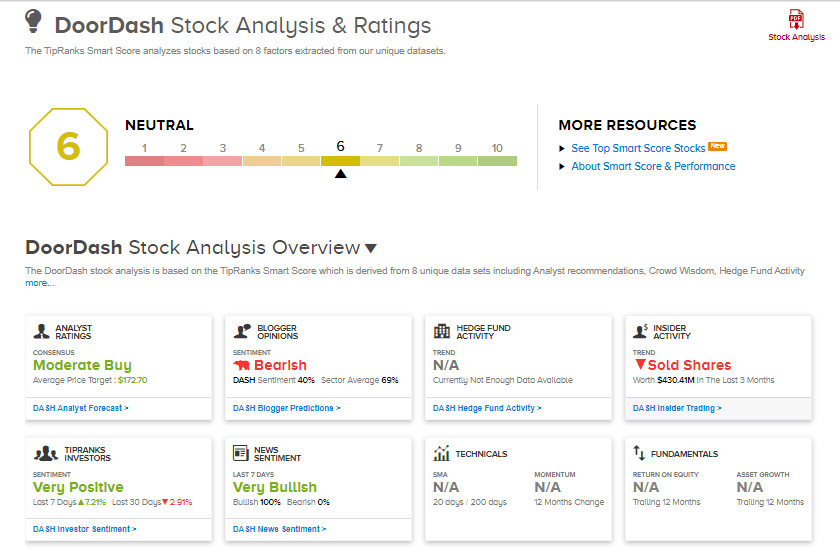

Consensus among analysts on Wall Street is a Moderate Buy based on 6 Buy and 6 Hold ratings. The average analyst price target of $172.70 implies 22.42% upside potential to current price levels.

DASH scores a 6 out of 10 on TipRanks’ Smart Score rating system, indicating that the stock’s returns will likely align with the market expectations.

Related News:

Ralph Lauren Sells Club Monaco Unit to Regent, Focus on Core Brands

Sonos Reports Profit and Boosts Outlook; Stock Jumps 7.43%

Amazon’s AWS Selected to Tackle NFL’s Quadrillion Schedule Options