DoorDash (NASDAQ:DASH) is looking to use its financial strength to diversify beyond its primary business of delivering meals, the Financial Times reported. With a growing cash reserve, the food delivery giant is exploring investment opportunities.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Per the report, DASH’s CEO Tony Xu is focusing on expanding into new markets outside the U.S. and diversifying beyond delivering restaurant meals to homes. It’s worth noting that DoorDash, in a similar move, acquired Wolt Enterprise in 2022 to accelerate its product development and increase its international scale. Including DoorDash and Wolt marketplaces, the company now has a presence in 25 countries.

Further, DoorDash had cash and cash equivalents of $2.3 billion on September 30. Moreover, on a trailing 12-month basis, it generated a free cash flow of $878 million. With this backdrop, let’s look at the Street’s forecast for DASH stock.

Is DoorDash Stock Expected to Rise?

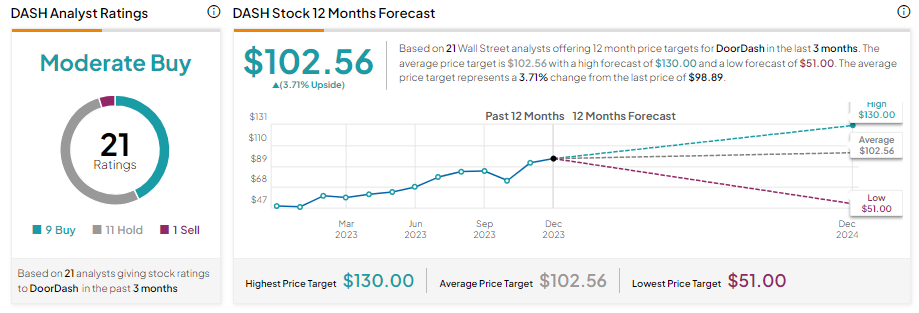

DoorDash stock has increased about 105% over the past year, reflecting increased active users and orders. Further, the total dollar value of orders completed on its marketplaces remains strong. However, due to the rally in its share price, DASH stock has limited upside potential based on analysts’ average price target.

DASH stock has received nine Buy, 11 Hold, and one Sell recommendations for a Moderate Buy consensus rating. Further, analysts’ average price target of $102.56 implies 3.71% upside potential.