Palantir (NASDAQ:PLTR) has planted itself right in the middle of the AI conversation, leveraging its expertise in big data – an area where AI delivers significant advantages. Its positioning has been the basis for some robust real-world growth, one that the market has rewarded, and some – PLTR stock has gained 2,285% during the past 3 years.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Investors are obviously over the moon about that, but many have questioned what has become a very inflated valuation.

Piper Sandler’s Clarke Jeffries acknowledges that there is “no argument PLTR’s valuation leaves no margin for error, particularly if any signs of moderating growth emerge.” That said, the analyst thinks that there is little sign of that right now.

The company boasts “tremendous visibility” on future revenue – over $7 billion in defined contracts plus an estimated $4 billion in IDIQ contracts – alongside year-to-date triple-digit growth in Commercial bookings. And with the potential to capture a larger share of the $1 trillion U.S. Defense market, the company could double or triple its current government business while still being far smaller than the top Defense primes.

“PLTR has not reached peak growth & therefore we do not see a catalyst to halt current momentum,” Jeffries said.

The analyst believes the Defense sector is undergoing a “profound shift,” moving away from large, costly assets toward more agile, software-driven, and unmanned solutions. Over the past five years, the U.S. federal government has spent an average of $147 billion annually, with the top five defense primes – roughly 16% of total Defense spending. In FY24, Palantir broke into the top 100 Department of Defense vendors for the first time, ranking at 96, while the 95 larger vendors collectively accounted for $285 billion in spending.

“We pose this scenario to investors – if 0.5% of Defense spending moved in the favor of Palantir, the company’s overall gov. business could increase 5x & still be 7x smaller than Lockheed Martin,” Jeffries pointed out.

The Government work is supported by its Commercial endeavors. And here too, Jefferies thinks a sizable opportunity is still up for grabs. The analyst views Palantir as a “secular beneficiary” from the fundamental shift in how both government and commercial organizations build applications and data infrastructure in the AI era. After heavy investment in AIP, the analyst believes the company’s Commercial traction is “reaching a distinct inflection point,” driven by “fast, transformative delivery of AI.” With management calling for implied 89% growth in U.S. Commercial revenue in the second half of the year and a 145% year-over-year increase in remaining deal value last quarter, Jefferies sees no reason to believe that Palantir’s commercial growth has peaked.

As such, Jeffries rates PLTR shares an Overweight (i.e., Buy), while raising his price target from $182 to $201, suggesting the stock will gain 13.5% over the coming months. (To watch Jeffries’ track record, click here)

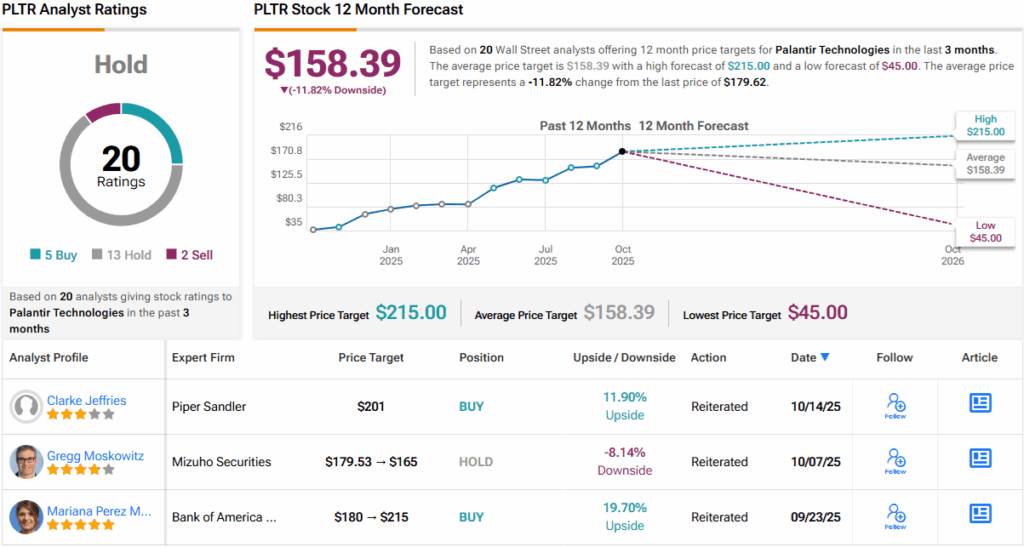

However, his bullish stance isn’t widely shared on Wall Street. While 4 other analysts also recommend buying PLTR, the majority remain cautious. With an additional 13 Holds and 2 Sells, the stock claims a Hold (i.e., Neutral) consensus rating. The average price target of $158.39 implies a possible 12% decline over the next year. (See PLTR stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.