Investing in Lucid Group (NASDAQ:LCID) has been far from a pleasant ride for some time now. The stock has experienced an almost constant downtrend for several years, and the past week only added to the luxury EV maker’s ongoing woes.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Since last Thursday, the stock has plummeted by 24% as investors reacted negatively to the company’s decision to dilute its shares – a move that is rarely welcomed by the market. Lucid announced plans to issue 262.4 million common shares, along with a private placement of 374.7 million shares to Ayar Third Investment Company, a subsidiary of Saudi Arabia’s Public Investment Fund (PIF), its majority shareholder. Together, these public and private shares represent a 28% of the company’s previous outstanding share count.

Bank of America analyst John Murphy reckons these transactions will net the company between ~$1.7 billion and $1.9 billion. However, he also emphasizes that this amount is just a drop in the bucket compared to Lucid’s needs. “Recall,” the analyst reminded investors, “we have assumed the company would need to raise more than $10bn over the next few years to get to self-sustaining status.”

While Lucid’s vehicles have garnered glowing reviews, it hasn’t been enough to change its fortunes. Murphy, too, is impressed with the company under Peter Rawlinson’s leadership, but he remains hesitant to fully endorse the bullish case just yet.

“We view the company as one of the most attractive among the universe of start-up electric vehicle (EV) automakers. We also believe LCID has more pieces of the puzzle in place and in process than most of its peers and it is steered by a management team with impressive experience,” Murphy said. “That said, we now expect it could take until 2027+ for LCID to breakeven on an operating and cash flow basis and it would need to raise a substantial amount of capital over the next few years. Therefore, we reiterate our Neutral rating.”

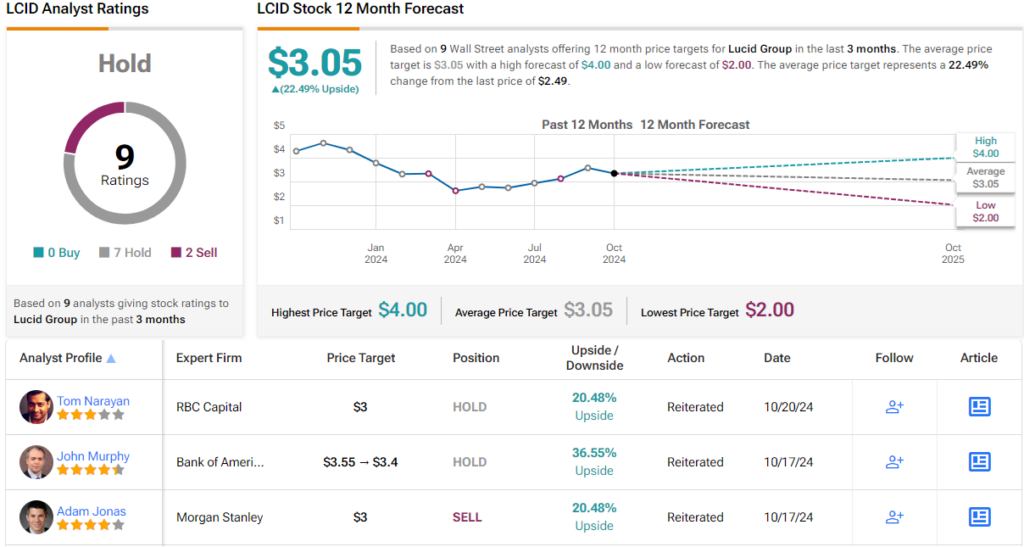

Murphy’s Neutral rating comes with a price target of $3.40, down slightly from $3.55. In a sense, though, Murphy might have just as well have said Buy, given that figure suggests the shares are undervalued by 30%. (To watch Murphy’s track record, click here)

Among the 8 other analysts who have recently chimed in on Lucid shares, 2 are sounding the alarm to stay away, while 6 are taking a wait-and-see approach, making the consensus view here a Hold. Even so, the average price target of $3.05 points to potential one-year gains of 22.5%. (See LCID stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.