Investors were not impressed with Alibaba’s (NYSE:BABA) latest quarterly results unveiled yesterday. Following the company’s indication of a continued deceleration in ecommerce growth during the third fiscal quarter of 2024 (December quarter), shares dipped ~9% over the past two trading sessions.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Revenue at the Chinese tech giant’s Taobao and Tmall Group (TTG), its core e-commerce segment, climbed by 2% year-on-year compared to 4% growth in the previous quarter, reaching 129.07 billion yuan ($17.98 billion). In total, revenue reached 260.35 billion yuan ($36.61 billion), amounting to a 5% y/y increase, just falling shy of the 262.07 billion yuan expected on Wall Street.

Adj. EPS (per ADS) also fell short, at 18.88 yuan, below the consensus estimate of 19.12 yuan. In what is considered an investor friendly move, the company also announced an increase of $25 billion to its stock buyback program but that failed to boost sentiment.

Nevertheless, Truist’s Youssef Squali, a 5-star analyst ranked in the top 2% of Street experts, offers a positive take, pointing out that TTG saw “healthy growth” in GMV with both buyers and order volume increasing compared to the same period a year ago. This, says the analyst, indicates “early underlying improvement in BABA’s competitive positioning and the health of the marketplace, albeit offset by a decrease in avg. order value (AOV).”

BABA is having to deal with the rise of other value-for-money competing platforms, so pressure on AOV is to be expected. With the aim of increasing investments in 2024 and “re-accelerating” revenue growth, the company also appointed a new management team for TTG in the quarter.

The latest pullback in share price is part of a wider trend for BABA with the stock entirely excluded from the past year’s tech rally and showing trailing twelve-month losses of 31%.

Still, Squali sees several reasons to remain on board here. These include: “1) compelling valuation (1x EV/Revs and 4.4x EV/AEBITDA), 2) improving order volume growth at Taobao/Tmall fueled by greater focus and investments, 3) strong FCF generation (11% FCF yield) which is fueling a capital return strategy with larger buybacks and dividends; and 4) prospects for a macro recovery as mgmt strengthens its competitive offerings for TTG, Int’l and Cloud.”

Given CY24 will be an investment year for BABA, Squali thinks margins will be kept in check near-term, however, the analyst believes much of it is “already reflected in the current valuation.”

To this end, Squali rates BABA shares a Buy, although his price target is lowered from $120 to $114. That said, there’s still potential upside of 60% from current levels. (To watch Squali’s track record, click here)

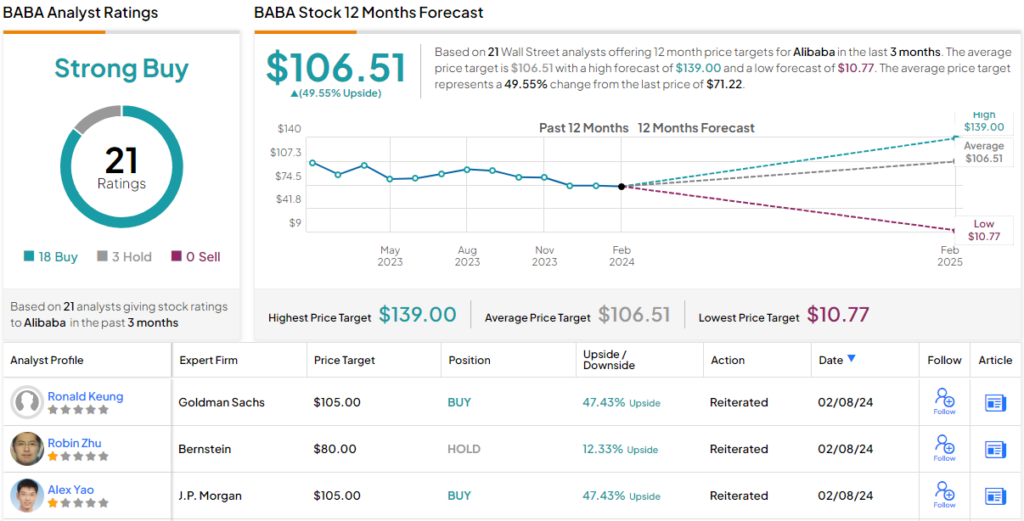

It appears the rest of the Street sees plenty of upside, too. The average price target hits $106.51, and implies potential upside of ~50% over the coming months. Based on 18 Buy ratings and just 3 Holds, the analyst community rates BABA a Strong Buy. (See Alibaba stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.