The S&P 500 has just had its best first quarter since 2019, but go tell that to Lucid Group (NASDAQ:LCID) investors.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

EV makers are dealing with a particularly difficult environment right now, affecting even the sector’s biggest names. Yet, the smaller operators trying to make headway are suffering even more and that has obviously been impacting market sentiment. Along with ongoing real-world challenges, LCID shares are already down 35% this year and by 65% over the past 12 months.

There was some temporary respite for the stock last week, albeit only a brief one. Investors gave a short around of applause to the news Lucid has secured a $1 billion investment from Ayar Third Investment, an affiliate of ~60% controlling shareholder the Saudi PIF (Public Investment Fund), via the sale of a newly created series of convertible preferred stock.

Lucid plans to utilize the funds raised from the private placement for various corporate needs, possibly capital investments and operational expenses, as well as other general purposes.

The amount raised is slightly lower than what Morgan Stanley’s Adam Jonas was expecting ($1 billion is equal Jonas’ estimate of FCF loss in 1H24), yet, he calls it a modest positive.

“LCID’s largest shareholder has underpinned recent capital raising activity to date. We had begun to question the continuation of support given a range of other EV-related alternatives in the market,” says the analyst, who thinks the announcement “helps reinforce commitment.”

That said, it will take more than that for the LCID story to show it is a viable long-term play. “Beyond the support of its largest shareholder, LCID’s long term success will come down to the company’s ability to produce vehicles for a BOM cost lower than selling price, ramping the Gravity in a profitable/ capital efficient way and looking for other avenues to extract value from its exciting IP and technology portfolio (licensing, etc),” Jonas went on to add.

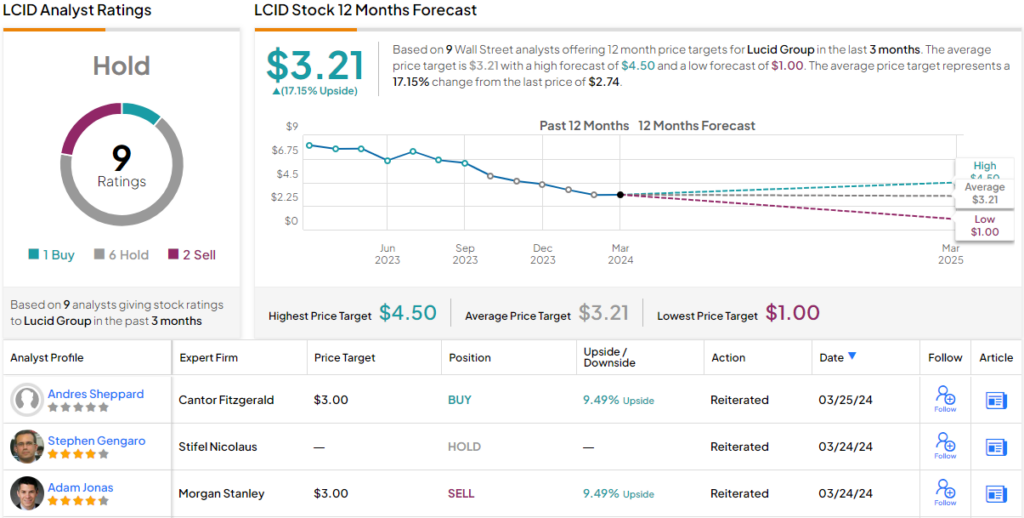

All in, despite the positive news, Jonas remains a LCID bear, rating the shares as Underweight (i.e., Sell) although his $5 price target offers a 9% upside for the year ahead. It will be interesting to see whether the analysts lower his target or upgrade his rating over the coming months. (To watch Jonas’ track record, click here)

Amongst Jonas’ colleagues, one other analyst joins him in the bear enclave, only one takes a positive stance, while most – 6, in total – remain on the sidelines with Holds ratings. The average target stands at $3.21, and factors in one-year returns of 17%. (See LCID stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.