Archer Aviation (NYSE:ACHR) has carved out a strong position in the up-and-coming segment of flying taxis – or more officially, eVTOL (electric vertical takeoff and landing) aircraft – helping to build a notable buzz around the stock. The shares have gained significant momentum, soaring 309% over the past year, as investors anticipate major growth for both Archer and the nascent industry that promises to dramatically shorten travel times across urban areas.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

But it should be noted from the off that making this compelling idea a reality is what really matters, and we are not quite there yet – neither Archer nor any other company has a fleet of air taxis flying across cities.

But that could change soon. Archer’s flagship eVTOL, the Midnight, is built to carry four passengers and a pilot on short urban routes, offering quieter, faster, and cleaner travel than cars. The company aims to launch a new air taxi network with airline and rideshare partners.

And there are some big names involved. United Airlines has conditionally ordered up to 200 aircraft, Stellantis will provide manufacturing support, and the U.S. Department of Defense is exploring military uses. With all that in place, Archer plans to begin commercial flights in 2026, pending FAA approval.

“If successful,” says investor Lawrence Nga, “Archer could tap into a market that analysts believe could reach trillions of dollars within the next few decades.”

Meanwhile, Archer has been building momentum as it nears FAA certification, with six Midnight in production – three already in the final stages of assembly. It also delivered its first Midnight to the UAE for flight tests in Abu Dhabi, with payments expected later this year. As such, Nga thinks the company represents a “bold bet on the next wave of mobility.”

However, there are caveats. Despite the potential, Nga points out that Archer faces major risks. Its heavy cash burn – over $700 million annually – continues with no commercial revenue, meaning more fundraising and likely shareholder dilution ahead. Secondly, competition is fierce, with rivals like Joby and Lilium racing ahead, leaving Archer under pressure to keep up in a crowded field. Additionally, FAA certification remains the “most significant hurdle,” while production challenges could also delay rollout.

So, while Nga concedes Archer is the “type of stock that captures imaginations,” the investor wants more proof that its ambitions are becoming reality before getting on board.

“For now, Archer Aviation looks better on a watchlist than in a portfolio,” Nga summed up. “If the company hits its milestones over the next few years, that stance could change.” (To watch Nga’s track record, click here)

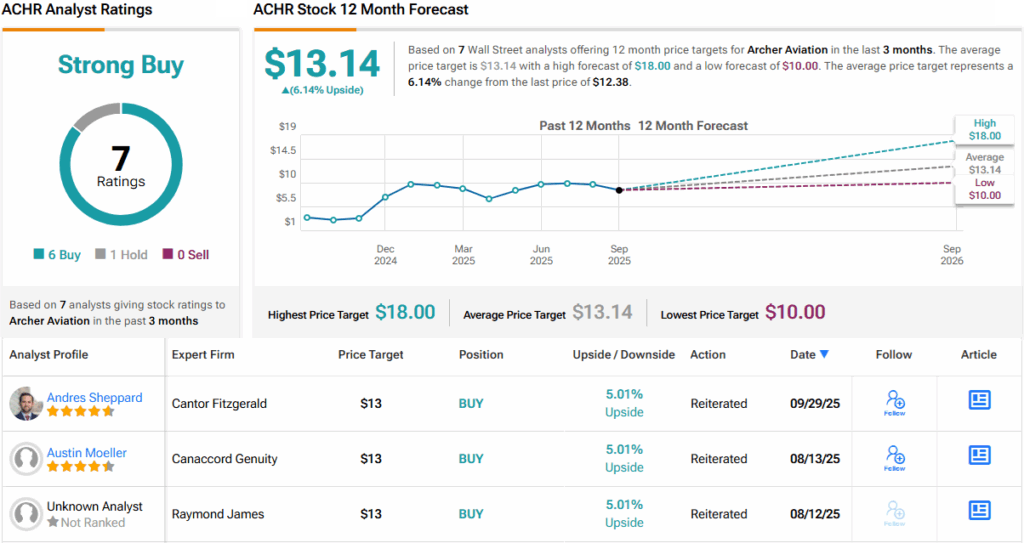

Amongst the Street’s analysts, one joins Nga on the sidelines, but with an additional 6 Buys, the stock claims a Strong Buy consensus rating. However, going by the $13.14 average price target, the stock will gain a modest 6% over the coming months. (See ACHR stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured investor. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.