Joby Aviation (NYSE:JOBY) shares have doubled since the start of the year, reflecting the excitement around the potential of eVTOL (electric Vertical Takeoff and Landing) aircraft to change urban travel. Those gains have not only far outpaced the broader markets, but they have also seen Joby beat other names in this up-and-coming segment, such as Archer Aviation (NYSE:ACHR) and Eve (NYSE:EVEX).

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Morgan Stanley analyst Kristine Liwag has an idea what’s behind the superior showing. “In our view,” says the 5-star analyst, “the stock’s outperformance reflects the market’s recognition that Joby continues to make meaningful progress toward its aircraft certification progress, which is the key unlock for the company’s business model.”

That progress has come with several developments in recent months. Joby has advanced toward aircraft certification, acquired Blade Air Mobility’s Passenger Division, launched joint ventures and partnerships with ANA Holdings and L3Harris Technologies, conducted aircraft test flights in Dubai and Japan, and joined the White House eVTOL Integration Pilot Program.

Even with this momentum, Joby’s journey has not fully lived up to the ambitious roadmap laid out in its 2021 de-SPAC plan. Back then, the company expected to complete FAA Certification flight tests in 2022, obtain FAA Type Certification in 2023, begin commercial service in 2024, and scale operations by 2026. It also projected $721 million in 2025 revenue, a far cry from today’s consensus estimate of just $4.1 million. With FAA Type Certification now anticipated in 2026, Liwag has revised her expectations for the company’s production ramp-up and operational performance.

The analyst acknowledges that the highly regulated aviation environment remains a major hurdle. The FAA certification process has taken longer than expected, extending Joby’s timeline by roughly three years. Although investors have mostly taken this in stride, Liwag warns that the risk surrounding FAA approval of the manufacturing process is still “underestimated.” Joby must secure an FAA Production Certificate, and every aircraft will need an Airworthiness Certificate before it can fly commercially. Factoring in these challenges, Liwag has trimmed her forecast for cumulative aircraft deliveries between 2026 and 2033 by 975 units – about 40% below prior estimates.

Still, there are reasons for optimism. Liwag sees potential upside in revenue per aircraft, citing significantly higher RASM (Revenue per Available Seat Mile) than originally assumed. Joby’s early market analysis pegged pricing to Uber Black rates, yet data from Blade’s helicopter operations in key markets suggests much stronger pricing power. Given that Joby’s aircraft should be cheaper, quieter, and safer than helicopters, Liwag now forecasts an average RASM of roughly $12 per mile from 2026–2033, up from around $2. Operating costs remain uncertain, since certification hasn’t been achieved, but her CASM (Cost per Available Seat Mile) estimate has been adjusted from about $1 to roughly $4.

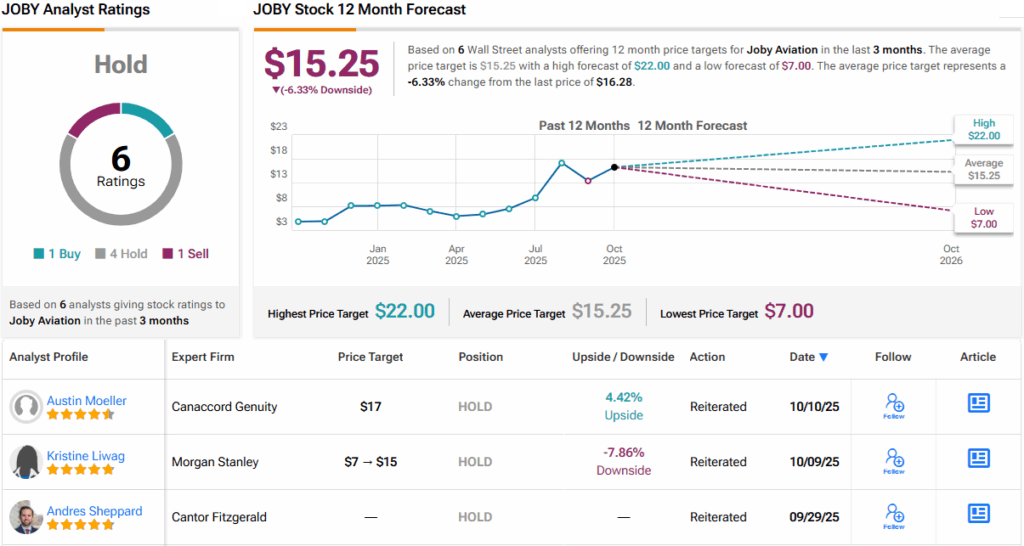

Taken together, these changes have prompted Liwag to raise her price target from $7 to $15. Even so, she assigns JOBY shares an Equal-weight (i.e., Neutral) rating, as the new target still implies an 8% downside over the next 12 months. (To watch Liwag’s track record, click here)

Among her colleagues, 3 other analysts join Liwag on the sidelines, while an additional 1 Buy and Sell, each, can’t detract from a Hold (i.e., Neutral) consensus rating. Going by the $15.25 average target, shares will be changing hands for a 6% discount a year from now. (See JOBY stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.