Rivian (NASDAQ:RIVN) stock has faced a bumpy ride in 2024, much like many other names operating in the embattled EV space. The shares have trended south for most of the year, with year-to-date losses reaching 55%.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Sentiment failed to improve when earlier this month the company announced the Q3 delivery/production haul. Deliveries in the quarter dropped by 36% year-over-year, marking the lowest level in more than a year and a half (the fewest since 1Q23). Additionally, the company said that production at its sole factory is being affected by a shortage of an unspecified component used across all its products. As a result, Rivian lowered its yearly production guide from the prior 57,000 to the range between 47,000 and 49,000 vehicles.

That said, despite the production issues, the company stuck to its delivery forecast of 50,500 to 52,000 vehicles for the year. According to J.P. Morgan analyst Ryan Brinkman, this suggests “unchanged demand,” though Brinkman remains skeptical that demand truly remains unaffected.

The analyst points out the softer Q3 deliveries don’t appear to be “supply-related,” as the company added 3,139 units to its inventory during the quarter (with production at 13,157 units and deliveries at 10,018). This marks the second-biggest quarterly inventory increase in its history, second only to the 3,569 units added in 4Q23 before the planned factory refit. In comparison, the company’s average quarterly inventory change has typically been just 950 units. “To us,” Brinkman goes on to say, “the implied softer demand trend suggests at least some risk to the outlook for full year deliveries, to which we move to 49K from 54K.”

As for how that impacts the stock, the slower production trend (and possibly softer deliveries) could put the company’s growth stock valuation at risk.

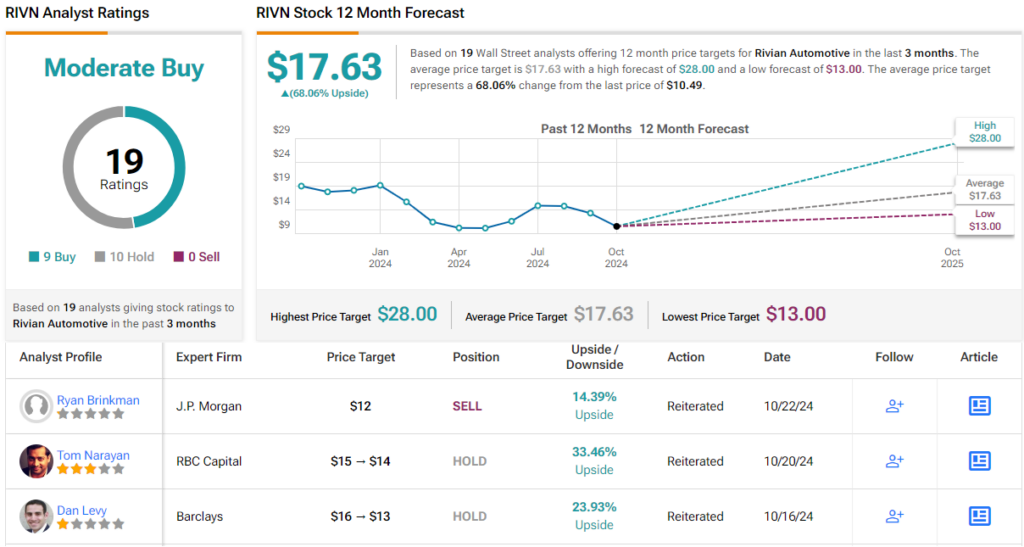

As such, Brinkman rates RIVN shares an Underweight (i.e., Sell), while cutting his price target from $14 to $12. That said, while Brinkman’s rating is decidedly negative, that figure still suggests the stock will gain ~14% over the next year, implying that even the bears think the share price has retreated by too much. (To watch Brinkman’s track record, click here)

Meanwhile, the broader Street sentiment remains more optimistic, with an average price target of $17.63, indicating potential 12-month gains of 68%. Brinkman is currently the only RIVN bear on the Street, with the consensus showing 8 Buys and 10 Holds, resulting in a Moderate Buy rating overall. (See Rivian stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.