Intel (NASDAQ:INTC) investors are probably still pinching themselves after the stroke of luck that came their way. The newly signed deal with Nvidia is more than just a morale boost and a $5 billion cash lifeline – it’s also a strong vote of confidence in Intel’s ability to deliver advanced technology and remain a relevant force in the industry.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Some analysts have even speculated that Nvidia could become Intel’s first major foundry client using the 14A technology, though neither firm was ready to commit to this possibility. What is beyond debate, however, is the market’s reaction – INTC’s share price has jumped 42% in the days since the news broke.

Still, Seaport analyst Jay Goldberg cautions that this wave of optimism is very much temporary in nature, arguing: “We think Intel is on the wrong path with a shrinking window to save their fabs.”

Goldberg assesses that Intel is looking to jettison its fabs, either by selling them off or shutting down operations completely. The analyst believes that turning them around – “a multi-year, deeply complex, painful process” – is in many ways a bridge too far for the company and its investors.

Moreover, Goldberg argues that its foundry is a drain on the company’s value, calculating that the overhang is costing Intel hundreds of billions. “The market is essentially arguing for Intel to close its fabs,” emphasizes the analyst.

Going forward, the analyst predicts that the short-term euphoria will likely be the prevailing force impacting INTC’s share price. He adds that there will very likely be other strategic investors adding their names to Intel’s ownership rolls, including major players such as Amazon, Apple, and Microsoft, among others.

However, according to Godlberg, that’s still not enough to address the major challenges facing the company. This extends beyond fabs and encompasses other spheres, such as a missing AI strategy, a worrisome gross margin, and potential cash flow issues related to attempts to overhaul its product and fab strategy.

In short, while the analyst is ready to upgrade Intel from Sell to Hold (i.e. Neutral) thanks to a potential near-term buying spree, he remains bearish on the company’s long-term prospects. (To watch Jay Goldberg’s track record, click here)

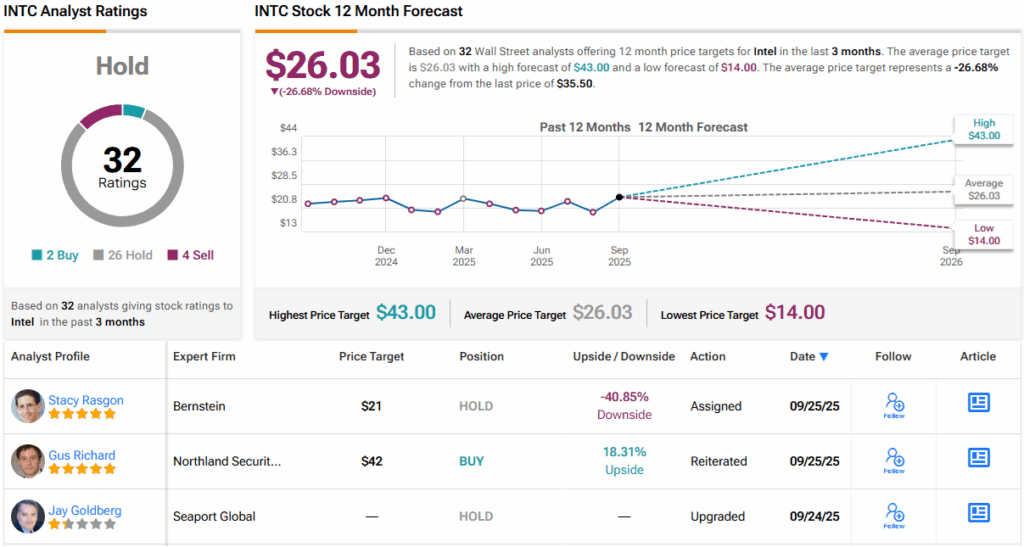

That cautious stance is broadly echoed across Wall Street. Most of Goldberg’s peers have reached a similar conclusion, with 26 Holds – alongside just 2 Buys and 4 Sells – giving INTC a consensus Hold rating. The 12-month average price target sits at $26.03, implying losses of ~27%. (See INTC stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.