Intel’s (NASDAQ:INTC) target is to regain its position as a leader in process technology, a stance it emphasized at its recent IFS (Intel Foundry Services) Direct Connect event.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The chip giant revealed a new roadmap, introducing the new 14A node, marking the first use of High-NA EUV. Additionally, Intel showcased a novel foundry framework tailored for AI, the world’s “first systems foundry for the AI era,” the groundbreaking initiative developed in partnership with chip designer Arm.

The company also outlined its ambition to become the world’s second-largest foundry by 2030, and noted the government has pledged its support in response to the escalating demand for AI technology. Moreover, tech colossus Microsoft was revealed as the latest Foundry customer, having opted for a chip design intended for production on the Intel 18A process.

Intel disclosed that wafer production for its Clearwater Forest processors using its 18A node had also begun. This milestone serves as further evidence that Intel’s ambitious objective of delivering five nodes in four years (5N4Y) remains on schedule for completion by year’s end. Consequently, Intel is confident in reclaiming the process node leadership from TSMC in 2025 with its 18A node.

Additionally, Intel has decided to rebrand IFS as Intel Foundry. The event served as Intel’s introduction as a ‘systems foundry,’ a term coined by Intel to signify its proficiency in system-level design, which encompasses all aspects of technology development, manufacturing, supply chain, and Intel Foundry Services, consolidating them as a unified group.

Attending the event, TD Cowen’s Matt Ramsay, an analyst ranked amongst the top 10 on Wall Street, was impressed with Intel’s latest moves. But is it enough for him to change his lukewarm stance on Intel stock? Not quite, at least for now.

“Overall,” said the 5-star analyst, “we acknowledge the incredible progress made on 5N4Y and lean positive on Intel’s chances for eventual process roadmap success as a big first step toward their product and foundry ambitions (not to mention recovered financials). However, we remain of the view that this process node turnaround is a necessary but insufficient milestone towards regaining product leadership in key verticals such as server and AI. That being said, the long-term holds a ton of potential if execution improves.”

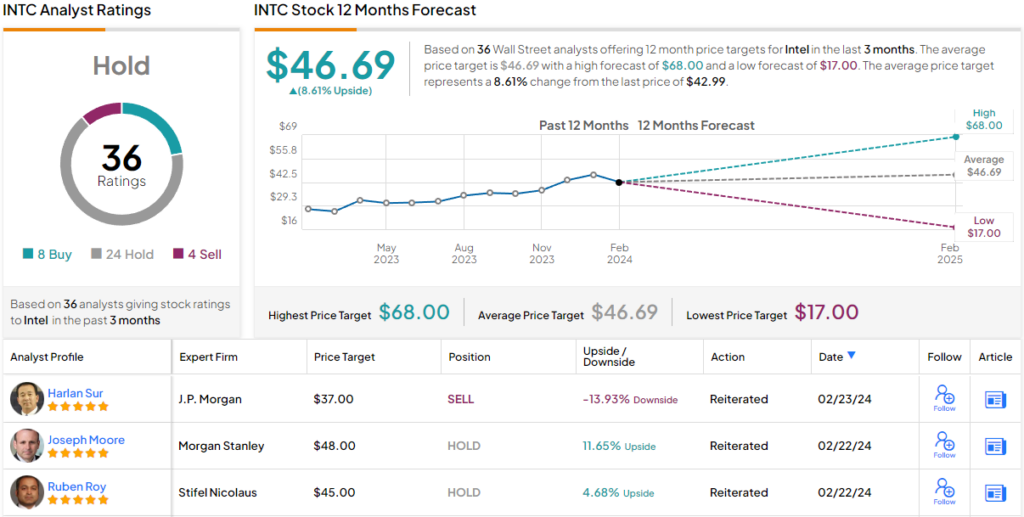

For now, Ramsay remains on the sidelines with a Market Perform (i.e., Neutral) rating and $42 price target, implying Intel shares are currently fully valued. (To watch Ramsay’s track record, click here)

Most analysts back that take. Based on an additional 23 Holds, 8 Buys and 4 Sells, the stock claims a Hold consensus rating. The average target stands at $46.69, making room for returns of ~9% in the year ahead. (See Intel stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.