Oklo (OKLO) has seen a truly astonishing surge, particularly this year. The Santa Clara–based company, which specializes in developing clean and affordable nuclear energy, has skyrocketed nearly 900% over this year, with about 650% of that gain coming since January.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Driving this explosive rally is a combination of favorable regulatory momentum and the massive surge in energy demand expected from AI in the coming years. However, with limited cash reserves and substantial capital needs ahead, Oklo will likely face significant equity dilution to fund the construction of its first reactors — along with the broader infrastructure required to support them.

And that doesn’t paint an amiable picture for the investment case—promising, yes, but highly speculative, with extreme execution and technological risks priced at an almost unimaginable premium. Even if the long-term nuclear narrative remains exciting, I believe Oklo’s current ~$24 billion market cap is excessive. I expect sharp corrections ahead, even if they take time to materialize, and therefore assign OKLO a Sell rating.

Deconstructing the OKLO Investment Case

The investment thesis around Oklo is rather complex, as it revolves around a company developing a new generation of nuclear energy. Unlike the massive, traditional gigawatt-scale reactors, Oklo focuses on designing, building, and operating compact, fast, and modular reactors. Oklo’s growing prominence—with its market cap skyrocketing from around $1 billion in September last year to nearly $24 billion by mid-October—is primarily anchored in three main pillars.

The first is the surging global demand for energy, driven by the secular AI boom and the rise of energy-hungry data centers. At scale, intermittent renewables plus storage may not be sufficient or reliable for all use cases. In that context, Oklo is positioning itself as a clean, firm power provider for these critical loads.

The second factor involves the unfolding regulatory tailwinds and political support that nuclear power deployment has gained over the past year. In the U.S., progress has been made to streamline nuclear licensing and relax regulatory hurdles to encourage the adoption of clean, firm power. Two milestones stand out: in May 2025, President Trump signed executive orders directing agencies such as the Department of Energy (DOE) to simplify procedures and accelerate the approval of advanced reactors. In September, Oklo announced that the Nuclear Regulatory Commission (NRC) had accepted its “Principal Design Criteria” report for accelerated review—a key step toward validating its reactor design and expediting the licensing timeline.

Finally, the third point—but by no means the least important—concerns the high-profile backers surrounding the U.S. nuclear revival. Among them, OpenAI co-founder Sam Altman stands out as he personally owned roughly 2.6% of Oklo through his private investment vehicle, Hydrazine Capital, and served as Chairman of the Board until April 2025.

Oklo’s Deflationary Nuclear Power Plan

Turning to the company’s fundamentals, one of the key pillars of Oklo’s thesis lies in its disruptive economics. The company has laid out public projections for a relatively low levelized cost of electricity (LCOE)—essentially the average cost of generating a unit of power over the plant’s lifetime, allowing comparisons across different energy sources.

In addition, Oklo targets a capital cost of around $3,000–$4,000 per kilowatt for its first-of-a-kind reactors, known as Aurora. With this CapEx and an estimated LCOE of $40–$60 per MWh, Oklo claims its power could be cost-competitive with natural gas or solar. To put that in perspective, Oklo’s goal would mean cutting the cost of a nuclear kilowatt to roughly one-third of the industry’s current standard, making its reactors both highly competitive and subsidy-free.

That would be genuinely disruptive—putting nuclear power on par with solar-plus-storage solutions, but with complete stability and no intermittency. And because Oklo’s reactors are compact and modular, they could be replicated at scale, almost like “containerized” power plants—ideal for powering data centers and other energy-intensive facilities.

According to Bank of America (BAC), this model could be highly profitable based on assuming Oklo sells power at $110–$120 per MWh while generating it at $50–$60 per MWh, the implied internal rate of return (IRR) would be around 25%, which is a strikingly high figure for an energy project.

Priced Like a Powerhouse, Funded Like a Startup

After outlining the scale of Oklo’s ambitions and its crucial role in an energy-hungry world where AI demand may still be in its early stages, it is worth taking a closer look at how feasible it actually is for the company to meet those goals.

Oklo does not yet have an operating license from the Nuclear Regulatory Commission (NRC). Its first application, submitted in 2022, was rejected on technical grounds, and only now is the company’s updated design back under review. But it’s still highly uncertain when—or even if—the license will be approved. And logically, without a construction and operation license, Oklo cannot build or start up a commercial reactor. Each step must be approved individually—after all, this is nuclear energy we’re talking about.

Historically, the NRC has been slow and extremely risk-averse (which, to be fair, is understandable). On top of that, Oklo’s Aurora reactor is based on a sodium-cooled fast-reactor design, a technology never deployed commercially before. No company has yet managed to operate something like it at scale while maintaining both stability and low cost.

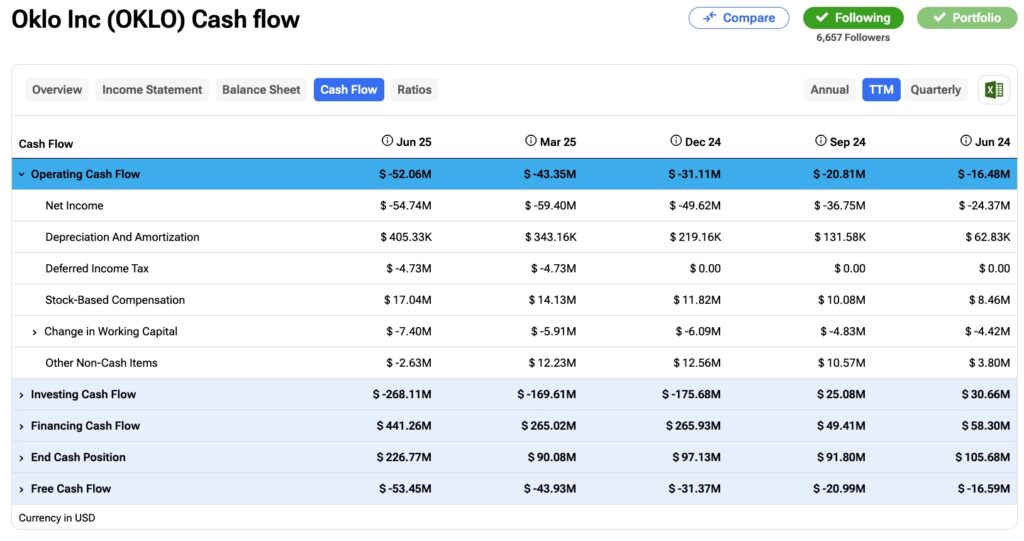

As a pre-revenue company, Oklo needs massive upfront investment and will only see potential returns several years down the road. At the moment, Oklo holds around $226 million in cash, but in the past twelve months, it reported negative cash from operations of $52.1 million. Simplified, that gives the company a cash runway of roughly 4.3 years at its current burn rate—though that rate will almost certainly accelerate sharply once construction begins and the company expands its operational infrastructure and team.

In practice, much of this funding will likely come from equity issuance, as seen over the past year when outstanding shares increased by about 21%, significantly diluting existing shareholders.

Analysts currently estimate that Oklo might only turn profitable around 2030, and that revenue could exceed $1 billion by 2031. Considering the company’s current market value of nearly $24 billion, this reflects a highly optimistic valuation for what remains an ultra-speculative stock—one that will have to consistently dilute shareholders to finance its ambitious nuclear projects, all without any guarantee of success.

Is OKLO a Buy, Hold, or Sell?

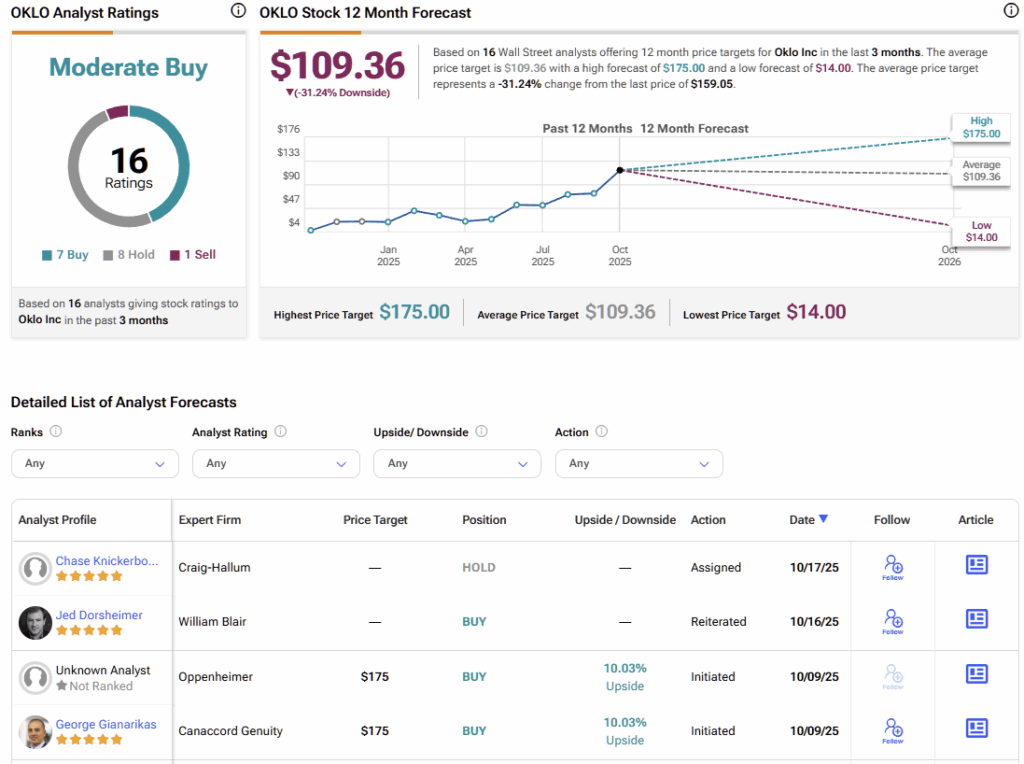

The analyst consensus on Oklo is moderately bullish. Over the past three months, seven of 16 ratings have been Buy, eight are Hold, and only one is Sell. However, there remains apparent skepticism around valuation, as the average stock price target of $109.36 implies a downside potential of about 31% over the coming twelve months.

The Longevity of Oklo’s Gravity-Defiant Valuation

While Oklo’s thesis is undeniably compelling—and makes perfect sense given the growing need for cheap, rapid, clean energy that AI-driven data centers will increasingly demand—the company’s current valuation of nearly $24 billion is simply too high. This is a business not expected to turn a profit for another five years, with revenues projected to exceed $1 billion only around six years from now. That’s an awfully long time to wait, especially if investors are considering going long at around the $100 mark.

Making matters worse, Oklo has yet to start construction on its fast reactors and will need substantial new funding — almost certainly through equity issuance, which could mean heavy dilution for existing shareholders. On top of that, safety concerns and potential regulatory backlash remain tangible risks if any incident occurs. And with Oklo’s technology still largely unproven, the uncertainty only grows — all factors that could pose serious challenges for OKLO stock bulls.

While hype and speculation may continue to drive sharp short- to mid-term rallies in Oklo’s stock, the company looks deeply overvalued at current levels. The most probable scenario is heightened volatility followed by significant corrections. For these reasons, I remain bearish on Oklo — despite its impressive technological marvels.