XRP (XRP-USD) derives its value proposition from being a cheaper and faster alternative to legacy cross-border payment providers, but the latest move by one of the companies it seeks to disrupt might spell trouble for the token.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

SWIFT has launched a crypto-enabled payment system, and while it’s not an entirely new service, it introduces a blockchain-based transaction ledger to the existing SWIFT network. The initiative brings together over 30 financial institutions, including major players such as Bank of America, Citi, JPMorgan Chase, and Toronto-Dominion Bank.

“Some of these mega-banks have been loud critics of blockchain solutions in the past,” says Anders Bylund, a top investor ranked in the top 2% of stock pros on TipRanks, who thinks it is “nice to see them on the other side of the argument here.”

The initial phase is an early-stage conceptual prototype developed by Ethereum backer ConsenSys. This setup merges SWIFT’s long-standing reputation for reliability with a fast, secure, and cost-efficient digital ledger, with Byland speculating it will likely be leveraging tokens on the Ethereum blockchain.

So, how much of a risk does this actually pose to XRP? Bylund thinks SWIFT’s blockchain endeavor is “just not that big of a deal — yet.”

The organization seems to be in a strong position, and Bylund notes rumors that stipulate it is also exploring an XRP-based payment system, while other blockchain initiatives could be underway but haven’t been made public.

Eventually, SWIFT could roll out multiple new payment rails that move money faster and at lower cost than traditional wires. A future Ethereum-based system might operate alongside an XRP-style setup, with other possibilities including flexible blockchain platforms like Polkadot, Solana, or Avalanche.

At their essence, says the 5-star investor, blockchains and cryptocurrencies are simply a modern approach to handling secure transactions and ownership worldwide, and Bylund sees no reason for SWIFT not to experiment with these digital ledgers across multiple parallel development projects. In the future, SWIFT transactions could run on different back-end systems, based on what works best for each situation.

“If I’m on the right track with this line of thought,” Bylund says, “I’m sure XRP will handle plenty of that business.”

Then again, Ethereum – and even the traditional bank-messaging systems – will likely remain part of the picture. What SWIFT will look like in five or ten years, or which cryptocurrencies will ultimately influence its services, remains to be seen. But rather than fading into obscurity, SWIFT is actively exploring the emerging world of digital payments.

“It’s not the end of XRP’s hopes and dreams,” Bylund summed up, “but perhaps the start of a more pleasant SWIFT experience.” (To watch Bylund’s track record, click here)

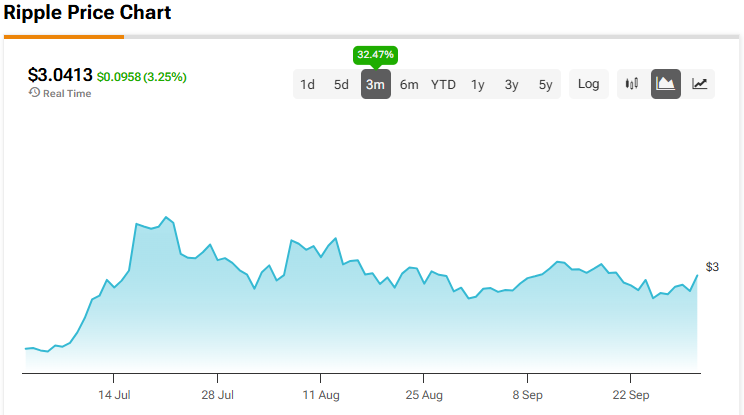

At the time of writing, XRP is trading at $3.04.

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured investor. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.