Pizza, particularly fast-food pizza like that served at Domino’s Pizza (NYSE:DPZ), has always been a fixture of American culture. And it delivered on its promise as a cultural touchstone in a big way today, jumping up more than 11% at the time of writing in Wednesday afternoon’s trading thanks to a new deal with Uber (NASDAQ:UBER). The deal was so good, in fact, that it left Domino’s competitor Papa John’s (NASDAQ:PZZA) reeling as a result, down fractionally.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The deal in question gave Domino’s Pizza access to the Uber Eats app, allowing Uber drivers to deliver Domino’s pizza to customers. This won’t be widespread at first, with only four markets involved. But should the initial moves work out well, the entire U.S will have access to the service by the end of the year. That’s a move that’s left analysts very happy; BTIG’s Peter Saleh notes that Domino’s plan here will likely light a fire under delivery purchases and also give franchisees a shot in the arm as well.

Further, it’s not just Uber Eats Domino’s is working with. Domino’s also tapped Postmates for a delivery arm. Domino’s CEO, Russell Weiner, noted that the new partnerships will likely help bring in a full billion dollars in new revenue. Given that same-store sales saw a drop in delivery orders of 6.6% back in February, adding new revenue to replace what’s already been lost so far this year will undoubtedly be welcome.

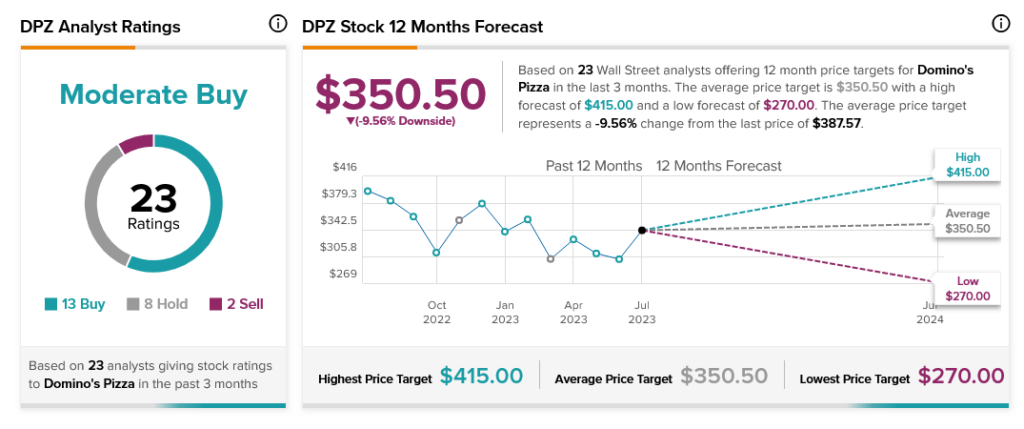

Analysts, meanwhile, are mainly in favor of Domino’s Pizza stock. With 13 Buy ratings, eight Hold and two Sell, Domino’s is considered a Moderate Buy. However, with an average price target of $350.50, Domino’s Pizza stock also comes with 9.56% downside risk as well.