Dollar Tree stock fell after Jefferies downgraded it to Underperform, warning that Walmart’s lower prices and nearby locations are eroding its competitive edge while rising costs and tariffs continue to squeeze margins.

Dollar Tree Stock Drops after Jefferies Slashes Forecast, Says Walmart Is Eroding Its Edge

Story Highlights

Dollar Tree stock (DLTR) dropped in early trading on Tuesday after Jefferies (JEF) downgraded the retailer to Underperform from Hold and cut its price target to $70 from $110. The analysts cited a combination of tariff pressures, rising costs, and intensifying competition from retail giants.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Shares fell 3.8% to $84.33 in pre-market trading. Even with the recent pullback, the stock remains up 17% year to date, outpacing the S&P 500’s 14% gain. Still, Jefferies warned that the company’s growth story is faltering as its once simple value model becomes harder to sustain in a changing retail environment.

Walmart Undercuts Dollar Tree on Price

Jefferies’ research found that Walmart (WMT) now offers lower prices on equivalent items than Dollar Tree, challenging the chain’s reputation as the home of everyday bargains. Compounding the issue, 87% of Dollar Tree stores are located within five miles of a Walmart, and 83% have a Dollar General nearby.

The analysts said this proximity is pressuring store traffic and weakening Dollar Tree’s ability to attract cost-conscious consumers. Walmart’s vast supply chain and scale allow it to undercut Dollar Tree on both price and pack size, erasing much of the discount retailer’s historical advantage.

Margins Squeezed by Tariffs and Costs

In addition to growing competition, Jefferies pointed to structural challenges weighing on profitability. Rising tariffs, higher labor costs, and the introduction of a new multi-price model offering items between $3 and $7 are all squeezing margins.

The new pricing strategy was meant to boost flexibility and appeal to a wider range of customers, but analysts say it has also added complexity to what was once a straightforward low-cost business. “Inflation, management decisions, and tariffs have turned a simple business model into a complex one,” the Jefferies team wrote.

Dollar Tree’s Earnings Outlook Weakens

Reflecting these pressures, Jefferies trimmed its 2025 earnings forecast by 6% and its 2026 estimate by 9%. The analysts warned that while Dollar Tree’s multi-price rollout and store remodels may improve long-term efficiency, near-term profitability will likely stay under strain.

In their note, Jefferies emphasized that the combination of macro headwinds and heightened competition makes it difficult for Dollar Tree to regain its footing. Without a clear path to margin recovery, investors may struggle to find upside at current valuations.

Smaller Players Are Struggling to Stand Out

The downgrade highlights a broader shift in U.S. discount retail. As Walmart and Dollar General expand their private-label and budget-friendly offerings, smaller players like Dollar Tree are finding it harder to stand out. For decades, the company thrived on the simplicity of the $1 price tag, but inflation and evolving consumer expectations have forced it to adapt at a cost.

Dollar Tree has not yet commented on the downgrade. However, analysts suggest that unless it can restore pricing clarity and operational simplicity, its stock could face continued pressure in the quarters ahead.

Is Dollar Tree Stock a Good Buy?

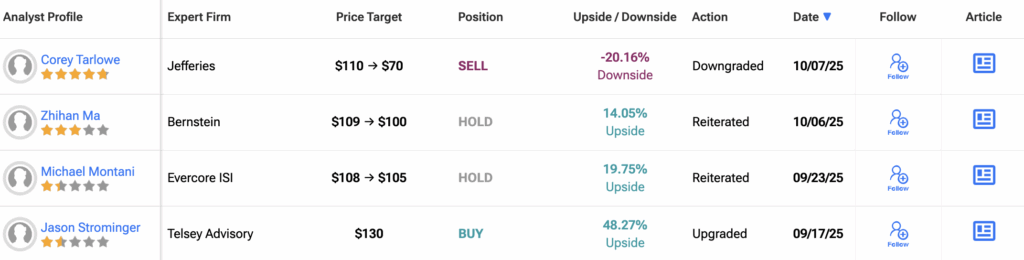

Wall Street remains cautiously optimistic on Dollar Tree stock, with the consensus rating standing at “Moderate Buy.” The outlook is based on 21 analyst ratings over the past three months, consisting of eight Buy recommendations, 11 Holds, and two Sells.

The average 12-month DLTR price target among these analysts is $114.18, implying a 30.22% potential upside from the stock’s most recent closing price.

1