Shares of discount price retailer Dollar Tree (NASDAQ: DLTR) crashed in morning trading at the time of publishing on Thursday after the retailer trimmed its diluted EPS forecast for FY23 to be in the range of $5.73 to $6.13, including “an expected benefit of a $0.29 contribution from the 53rd week and the $0.12 charge for the legal reserve.”

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

In FY23, Dollar Tree anticipates net sales to be between $30 billion and $30.5 billion while comparable store sales are expected to be in a “low- to mid-single-digit” range.

Rick Dreiling, Chairman and CEO of Dollar Tree commented, “While we are maintaining our full-year 2023 sales outlook, we are adjusting our EPS outlook as we expect the elevated shrink and unfavorable sales mix to persist through the balance of the year. We still expect earnings to be more back-end loaded this year as the benefits of lower ocean freight rates flow through.”

In the fiscal second quarter, the management expects net sales to be between $7 billion and $7.2 billion, based on a mid-single-digit rise in same-store sales for the enterprise while Q2 earnings are likely to be in the range of $0.79 to $0.89 per diluted share.

In Q1, net sales increased by 6.1% year-over-year to $7.32 billion and above consensus estimates of $7.28 billion. DLTR reported Q1 adjusted diluted EPS of $1.47 but fell short of analysts’ estimates of $1.52 per share.

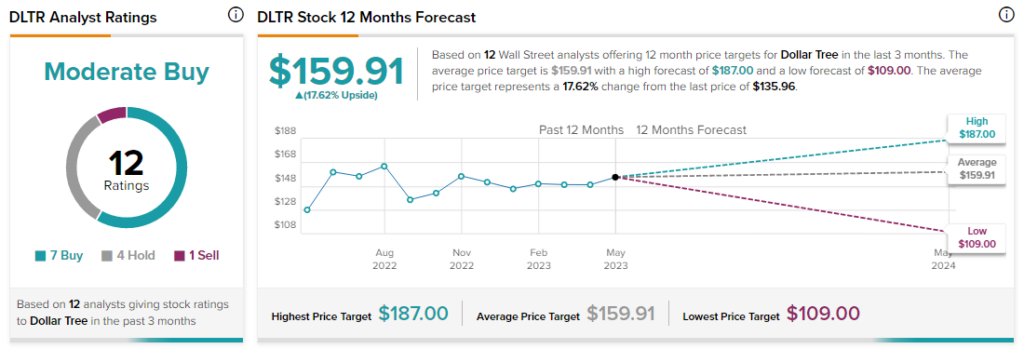

Analysts are cautiously optimistic about DLTR stock with a Moderate Buy consensus rating based on seven Buys, four Holds, and one Sell.