Dollar General (NYSE:DG) shares are on the rise at the time of writing after the discount retailer announced a better-than-expected performance for the third quarter. Additionally, the company reaffirmed its outlook for Fiscal year 2023.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

During the quarter, revenue increased by 2.4% year-over-year to $9.69 billion, exceeding estimates by $50 million. EPS of $1.26 fared better than expectations by $0.06. Still, this was a 45.9% decline in the company’s bottom line. Further, same-store sales decreased by 1.3%, and operating profit contracted by 41.1% to $433.5 million. While customer traffic trended higher, the company’s average transaction amount declined.

The sales growth for the quarter was primarily driven by positive momentum from new stores. In Fiscal Year 2024, the company plans to open 800 new stores and remodel 1,500 locations. For Fiscal Year 2023, net sales are expected to grow by 1.5% to 2.5%. Same-store sales growth is anticipated to be between 0% and -1%. Furthermore, EPS for the year is seen landing between $7.10 and $7.60.

Additionally, Dollar General has declared a quarterly dividend of $0.59 per share. The DG dividend is payable on or before January 23, 2024, to investors of record on January 9, 2024.

What is the Stock Price Forecast for DG?

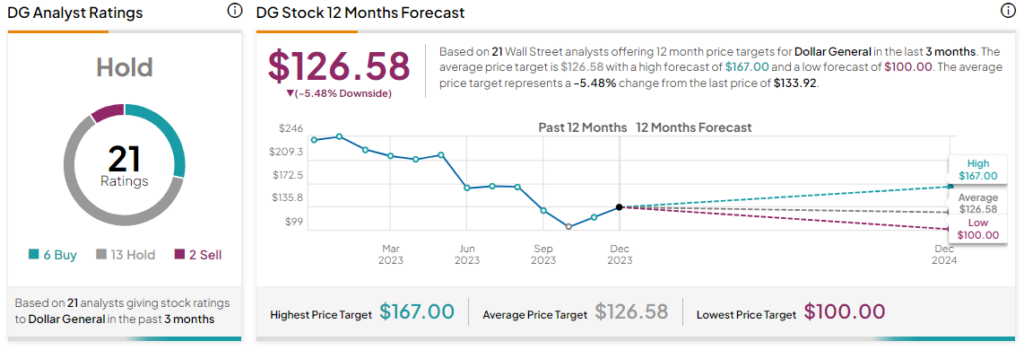

Amid broader market strength and holiday sales optimism, shares of the company have gained nearly 11% over the past month. Overall, the Street has a Hold consensus rating on Dollar General. The average DG price target of $126.58 implies a potential downside of 5.5% in the stock.

Read full Disclosure