Shares of e-signature and digital agreement management software provider DocuSign (DOCU) plunged 12.2% on Tuesday after ChatGPT maker OpenAI (PC:OPAIQ) unveiled its new product called DocuGPT. The arrival of an AI-powered document management tool sparked concerns about growing competition for DocuSign, triggering panic among investors.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

DocuSign Faces Rivalry from OpenAI’s DocuGPT

OpenAI’s DocuGPT is an agent that converts contracts into structured, searchable data. The AI company highlighted how it is enhancing its own operations by capitalizing on agentic AI, such as DocuGPT. It touted that DocuGPT ensures faster turnaround by cutting the company’s contract management work in half.

Additionally, OpenAI noted the higher capacity of DocuGPT and its ability to flag non-standard terms with reasoning and references. It added that tabular output in the data warehouse facilitates easier data analysis. Moreover, OpenAI stated that each cycle of human feedback sharpens DocuGPT, making every review faster and more accurate.

While OpenAI’s new AI tool presents increased competition for DocuSign, many experts believe that it may take several years for DocuGPT to have a significant impact on the company, given its dominance in the contract management market and a loyal customer base. Moreover, DocuSign has been enhancing its offerings through the integration of AI.

What Is the Target Price for DOCU Stock?

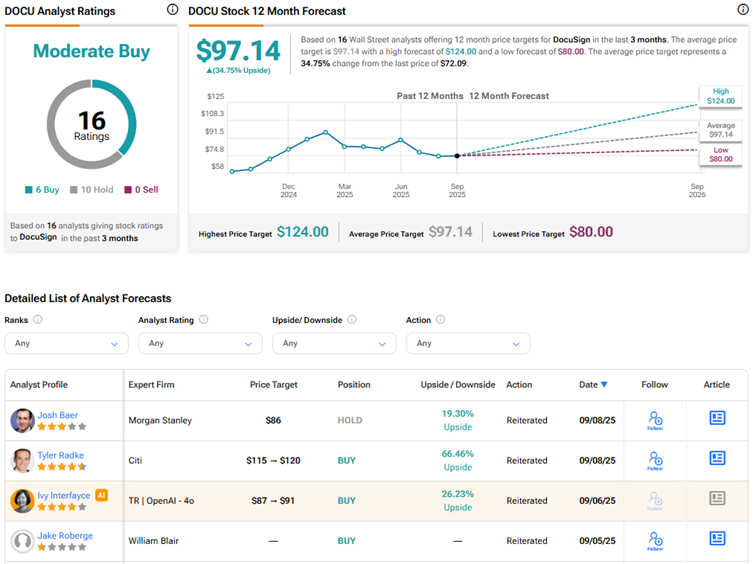

Currently, Wall Street has a Moderate Buy consensus rating on DocuSign stock based on six Buys and 10 Holds. The average DOCU stock price target of $97.14 indicates 34.8% upside potential.