Trouble ahead for information technology stock DigitalOcean (NYSE:DOCN)? It sure looked that way in Thursday’s trading. DigitalOcean started off down around 6% in Thursday’s premarket and stayed around that level most of the day, closing 5.67% lower in Thursday’s trading. Piper Sandler played the party pooper as it offered up some profoundly bad news about DigitalOcean’s likely future.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Piper Sandler, by way of analyst James Fish, lowered its appraisal of DigitalOcean shares from their previous Hold to Sell. However, Fish didn’t touch his price target, leaving it at the original $35 level. Fish had a laundry list of troubles currently facing DigitalOcean, particularly its heavy exposure to the small and medium-sized business (SMB) sector, which is most likely to face trouble in the economy likely coming up. Further, DigitalOcean’s usage model and revenue drying up were other key issues that would hold the company back. Perhaps worst of all, Fish claimed that DigitalOcean missed a much bigger opportunity when it failed to offer GPU-as-a-service, a move which would have helped considerably as AI systems need GPUs to work.

In fact, Russia generated another problem for DigitalOcean earlier today. Russia established a list of companies that it expects to either open local offices or face some form of penalty, up to and including an outright ban. DigitalOcean was just one of the firms on the list, including Amazon’s (NASDAQ:AMZN) own Amazon Web Services imprint and even Google (NASDAQ:GOOG) itself. Losing Russia’s business would only hurt DigitalOcean more than it already has been, though to what extent is somewhat unclear.

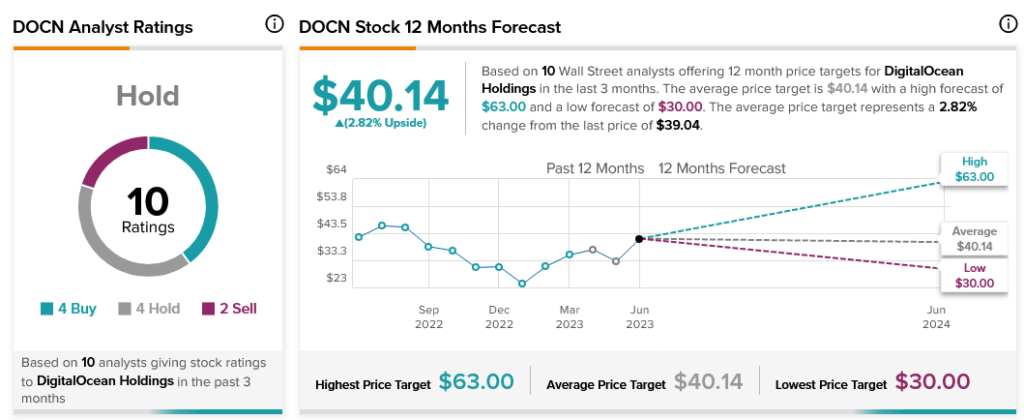

Analysts are split on DigitalOcean stock’s overall trajectory. With four Buy ratings, four Holds, and two Sells, DigitalOcean is considered a Hold. Moreover, it’s a Hold with little upside potential, as its average price target of $40.14 is just 2.82% higher.