It is not every day you hear about a chainsaw being recalled. After all, a chainsaw is an inherently dangerous tool, despite its incredible utility in removing wood and, by extension, providing heat. But at home improvement giant Home Depot (HD), one particular chainsaw is a little more dangerous than the others. That prompted a recall, and that recall led to an open decline in Home Depot share prices. Investors sent shares down nearly 2.5% in Wednesday afternoon’s trading.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The chainsaw in question is the M18 FUEL Top Handle Chainsaw, which reportedly encountered two cases of a brake safety component failing. There has been one injury reported with this, and that was enough for Home Depot to issue a “voluntary recall” on the device.

The recall covers 90,860 such chainsaws sold in the United States, and about another 7,500 of them sold in Canada. The saws were sold between March 2023 and September 2024, and can be identified by a series of catalog numbers. The impacted catalog numbers are 2826-20C, 2826-22T, 2826-21T, and 2826-20T. This also includes chainsaws where the fourth digit of the serial number is the letter A. Milwaukee Tool, which manufactures the saws, is offering a free repair via its Milwaukee Service Registration Portal, reports noted.

Shareholder Bonanza

Meanwhile, another report noted that Home Depot has handed back quite a bit of cash to its investors over the last 10 years, through a combination of dividends and buybacks. In fact, Home Depot has actually returned $130 billion cumulatively to its shareholders. This represents the 14th highest total return to shareholders in the stock market’s recorded history, reports note.

This is good news for shareholders, as it indicates that Home Depot management believes very strongly in the company’s ability to continue. If it had more doubt, then it would likely keep that cash on hand to weather potential downturns or augment current processes to produce more stable cash flows. But whether or not this can continue is anyone’s guess.

Is Home Depot a Good Long-Term Buy?

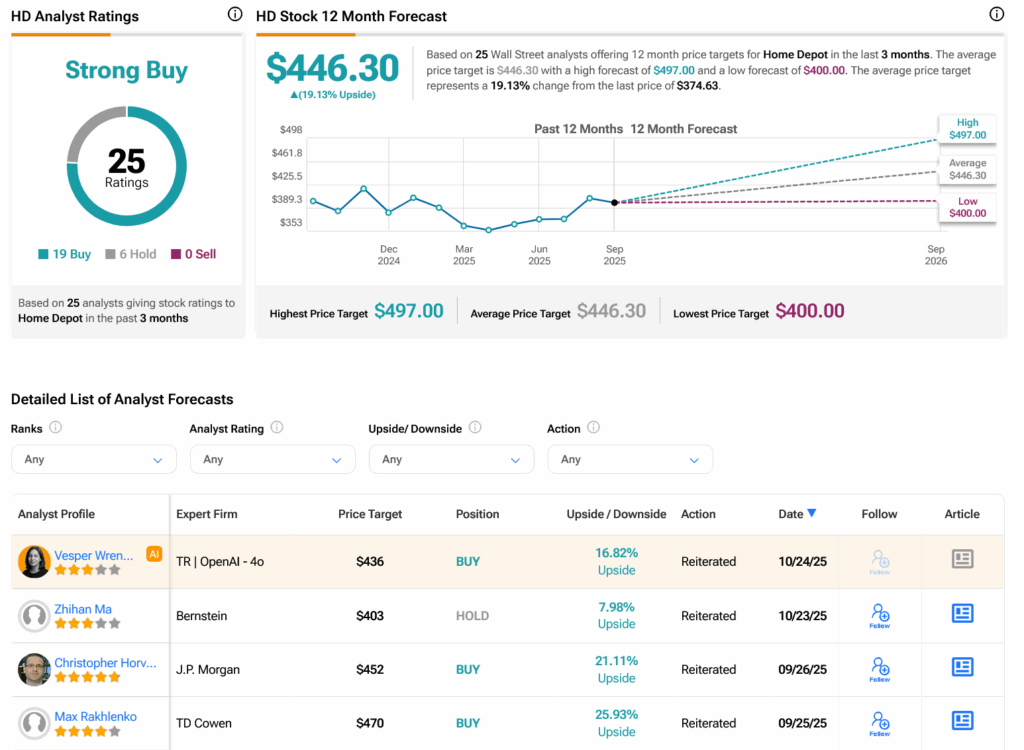

Turning to Wall Street, analysts have a Strong Buy consensus rating on HD stock based on 19 Buys and six Holds assigned in the past three months, as indicated by the graphic below. After a 1.36% loss in its share price over the past year, the average HD price target of $446.30 per share implies 19.13% upside potential.