Nvidia (NVDA) stock has gained 34.3% so far this year, supported by strong demand for its graphics processing units (GPUs) used in artificial intelligence (AI) applications. The company has also strengthened its market position through key partnerships, including a $5 billion investment in Intel (INTC) and a $100 billion deal with ChatGPT maker OpenAI (PC:OPAIQ).

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

However, growing competition from Advanced Micro Devices (AMD)—which recently signed new agreements with OpenAI and Oracle (ORCL)—along with the ongoing China chip export restrictions, has raised some investor concerns. Even so, most analysts remain confident in Nvidia’s long-term growth, with Wall Street’s average price target still pointing to further upside for the stock.

Analysts’ Views on NVDA Stock

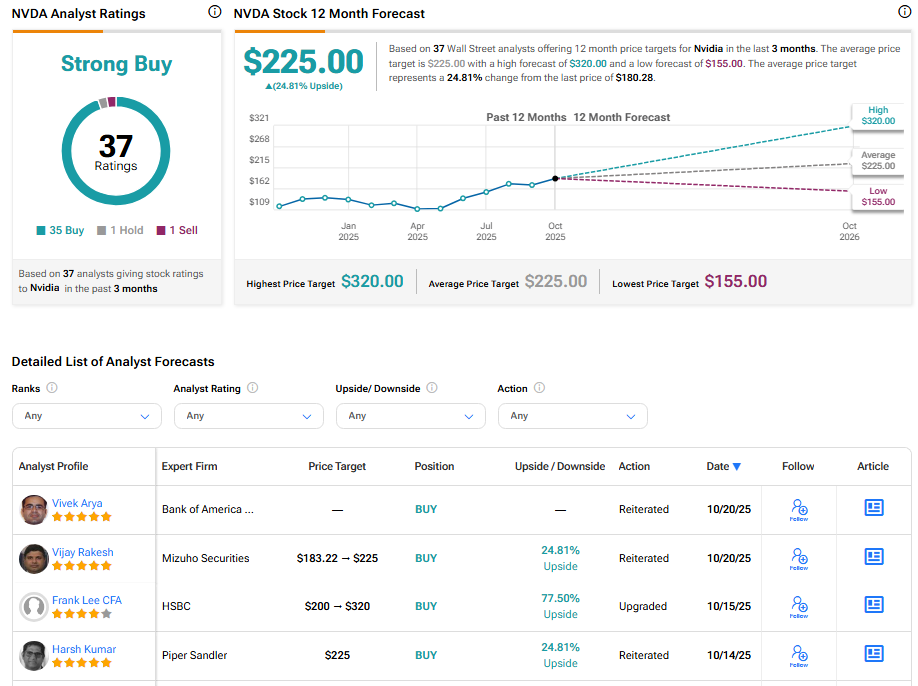

In a recent note, top Mizuho Securities analyst Vijay Rakesh reiterated an Outperform rating and a $225 price target on Nvidia. The five-star analyst said the company remains the clear leader in AI chips, holding more than 95% market share in AI data centers. Rakesh expects the segment to grow around 60% per year, reaching over $500 billion by 2028, driven by new products like the GB200 and NVL72/36 servers expected in 2025.

Meanwhile, HSBC analyst Frank Lee turned more bullish on the stock last week, upgrading Nvidia to Buy from Hold and raising his price target from $200 to $320 — the highest on Wall Street. He said Nvidia’s AI data center business is expanding faster than expected, with potential for strong earnings growth through FY27. Lee now forecasts FY27 data center revenue at $351 billion, about 36% above current Street estimates, and lifted his earnings forecast to $8.75 per share, compared to the market average of $6.48.

Lee also highlighted the rapid expansion of the AI GPU market, fueled by demand from major cloud players like Amazon (AMZN) and Microsoft (MSFT), as well as large-scale AI projects such as OpenAI and Stargate. While he acknowledged U.S.–China trade tensions as a near-term risk, Lee said easing conditions in 2026 could help revive Nvidia’s China sales despite growing competition from Huawei.

Is Nvidia Stock a Buy Right Now?

On TipRanks, Wall Street has a Strong Buy consensus rating on the stock based on 35 Buys, one Hold, and one Sell recommendation. The average NVDA stock price target of $225 indicates 24.81% upside potential.