Shares of Massachusetts-based 3D printing systems firm Desktop Metal (DM) lost 1.2% in early trade on Thursday after the company’s second-quarter 2021 financial results fell short of expectations despite revenues skyrocketing 767% year-over-year. Desktop Metal’s 3D printing solutions help transform the manufacturing process.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The company reported a loss of $0.17 per share, larger than the year-ago loss of $0.15 per share and the Street’s loss estimate of $0.09 per share. Quarterly revenues increased 68% quarter-over-quarter and 767% year-over-year to $19 million, marginally missing analysts’ expectations of $19.07 million.

Product revenues totaled $17.6 million, up from $1.5 million in the previous year. Services revenues rose to $1.4 million from $658,000 in the second quarter of 2020. Furthermore, new customers grew 44% quarter-over-quarter.

The CEO of Desktop Metal, Ric Fulop, said, “We continue to see significant opportunities to gain share in the additive manufacturing market by leveraging our industry-leading product portfolio and diversified materials platform.”

The company has reiterated its outlook for 2021 and continues to expect revenue of more than $100 million. Meanwhile, Desktop Metal’s shares fell 5.9% to close at $8.93 on Wednesday. (See Desktop Metal stock chart on TipRanks)

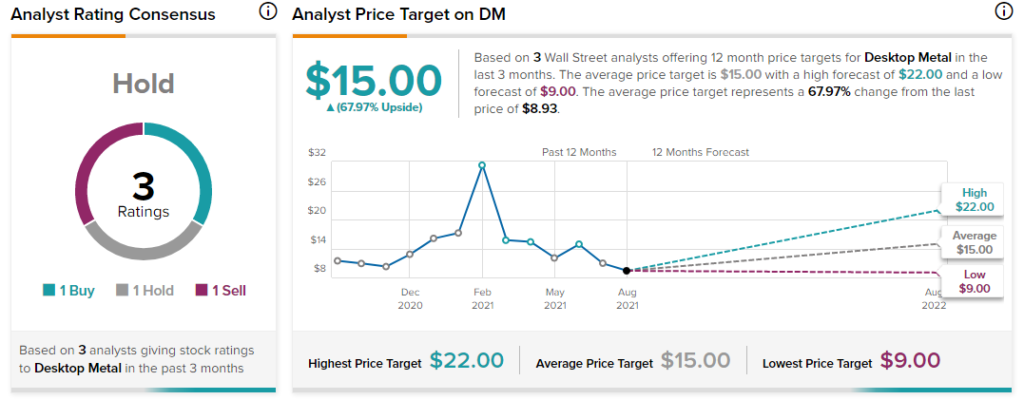

Last month, Lake Street analyst Troy Jensen maintained a Sell rating on the stock and reduced the price target to $9 from $11 (0.8% upside potential). The analyst expected Desktop Metal to report “impressive” quarter-over-quarter and year-over-year growth in the second quarter.

Overall, the stock has a Hold consensus based on 1 Buy, 1 Hold and 1 Sell. The average Desktop Metal price target of $15 implies 68% upside potential. Shares of the company have lost 70.7% over the past six months.

Related News:

Marqeta Reports Mixed Q2 Results; Shares Fall 9% After-Hours

What Investors Can Learn from Jazz Pharmaceuticals’ Newly Added Risk Factors

Haemonetics Exceeds Q1 Expectations; Shares Jump 7.4%