Any payment processor stock is going to be under a lot more scrutiny than most normal companies. But for DLocal (NASDAQ:DLO), that scrutiny may have kicked off something a lot worse than it ever wanted to see. Sufficiently worse, in fact, to send shares spiraling downward on a double-digit loss for Friday’s trading.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Despite how bad a double-digit loss is by itself, it’s actually part of a larger pattern of losses. DLocal lost around 35% since November after a report from Muddy Waters Research noted problems with DLocal’s “disclosures” and that, as a result, Muddy Waters shorted DLocal. DLocal, for its part, responded to the Muddy Waters report, calling it packed with “…inaccurate statements, groundless claims, and speculation.”

That alone would be bad news enough for any payment processor, but it only got worse when an Infobae report noted that the Argentinian government had plans to look into the matter and considered notifying the Securities and Exchange Commission in the U.S. about fraud allegations. DLocal likewise responded to the Infobae report, calling it “factually incorrect” and saying that it “…continue(s) to process payments normally in Argentina.”

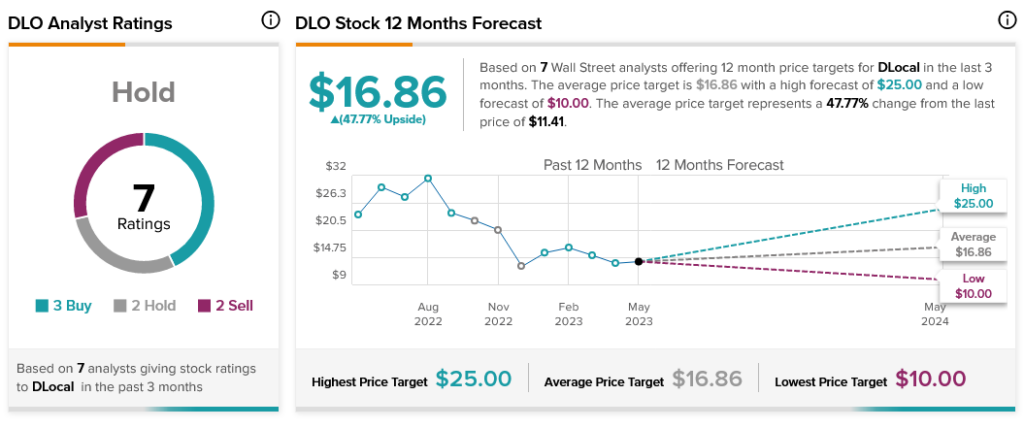

Analysts, meanwhile, are also feeling their skepticism. Currently, analyst consensus calls DLocal stock a “Hold,” thanks to three Buy ratings, two Holds, and two Sells. With an average price target of $16.86, DLocal stock offers 47.77% upside potential.