Disney (DIS) reports earnings this Wednesday, and Wall Street already has its eyes on a few key numbers. With streaming finally making money, theme parks firing on all cylinders, and buybacks returning, analysts are watching closely to see if Disney can keep the momentum going.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Disney’s Earnings Land on Wednesday Morning

Disney will report its Fiscal Q3 earnings on August 7 before the market opens. Analysts expect revenue of around $23.69 billion and earnings per share (EPS) of $1.45.

In that same quarter, Disney raised full-year EPS guidance to $5.75, and said streaming had finally become profitable. This week’s report will either validate that optimism or force a reset.

Disney’s Streaming Turns a Corner

For years, Disney’s streaming division was a money pit. That changed last quarter when it reported $336 million in streaming profit, thanks to price hikes, subscriber growth, and fewer losses at Disney+ and Hulu. CEO Bob Iger said, “We expect further improvements in profitability going forward.”

Disney’s turnaround in streaming is a key reason Jefferies just raised its price target to $144, citing stronger margins and continued subscriber growth. Expect investors to focus heavily on the segment this week, especially given the rising costs of content.

Disney’s Parks and Cruises Keep Delivering

The theme park and cruise segments are still a major cash machine. Domestic parks saw strong attendance, international parks saw improving margins, and cruise bookings came in stronger than expected. Disney has also announced expansion plans, including a new Abu Dhabi park and two more ships in its cruise line.

Analysts at Morgan Stanley say park revenue growth will remain steady as Disney leans into high-margin experiences and premium pricing. This week’s report will give more insight into Q4 travel trends and spending.

DIS Stock Buybacks Likely to Return as Confidence Grows

Disney restarted its share repurchase program earlier this year and has already begun buying back stock. CFO Hugh Johnston said the company would be “opportunistic but disciplined” with future buybacks. This is a major signal that management believes the stock is undervalued and the turnaround is real.

Expect any update on buyback pace or size to get Wall Street’s attention, especially with EPS guidance riding higher.

EPS Guidance Could Move DIS Stock

Right now, the market is pricing in full-year EPS of $5.75 to $5.78. If Disney raises that number again or narrows the range toward the top end, the stock could break above $120, where it’s been struggling. On the other hand, any stumble in parks or slowdown in streaming would likely spark selling.

Final earnings guidance is the most important line item this quarter. Strong results with weak guidance won’t cut it. Analysts want to see follow-through, especially on margins and free cash flow.

This quarter is Disney’s to lose. The business looks stronger across the board, and buybacks are giving the stock some tailwind. Now it comes down to whether the company can deliver another clean beat, and back it up with a forecast that keeps investors excited.

Is Disney Stock a Good Buy?

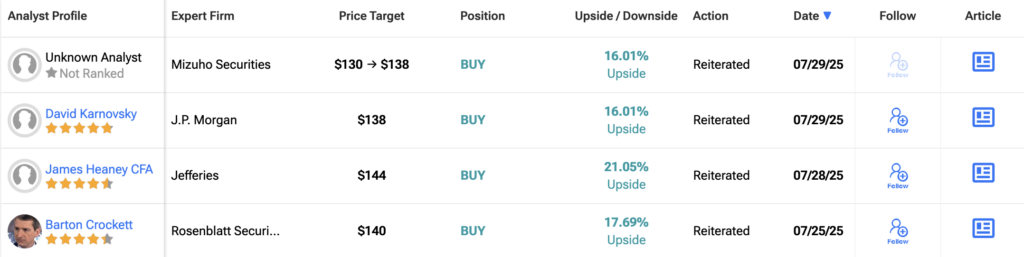

According to data from TipRanks, 20 analysts have issued ratings in the last three months, and 17 of them are calling it a Buy. None have issued a Sell. That puts Disney in “Strong Buy” territory.

The average 12-month DIS price target sits at $135.78, which would mark a 14.14% gain from the current price of $118.96.