Shares of Walt Disney (NYSE:DIS) experienced a marginal slide at the time of writing as KeyBanc Capital Markets downgraded the company to ‘sector weight.’ Analyst Brandon Nispel listed several factors for this change, one of the main concerns being high expectations for the Parks business. Other issues raised included apprehensions regarding Disney’s direct-to-consumer segment, which is seeing stalling subscriber growth. ESPN’s transition to streaming, according to Nispel, seems more challenging than initially anticipated, as consumer willingness to pay is relatively low. Changes in content distribution structures and an indistinguishable financial outlook for 2023 and 2024 also contributed to this shift.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The Parks business, often lauded as a Disney success story, also came under Nispel’s scrutiny. Despite estimated growth rates of approximately 6% and 8% for the third and fourth fiscal quarters, Nispel suggested the possibility of this growth decelerating. He argued that based on current attendance data and a mere 2% rise in per capita spending in Q2, it’s uncertain if these positive trends will continue.

Finally, Nispel expressed concern over Disney’s streaming services, particularly Disney+ and Hulu. He noted that while Disney has begun to drive pricing, their services haven’t yet managed to distinguish themselves in terms of subscriber retention, despite their bundling advantage. He pointed out that in the direct-to-consumer space, Netflix clearly leads and predicted a net loss for Disney+ and Hulu in the next quarter.

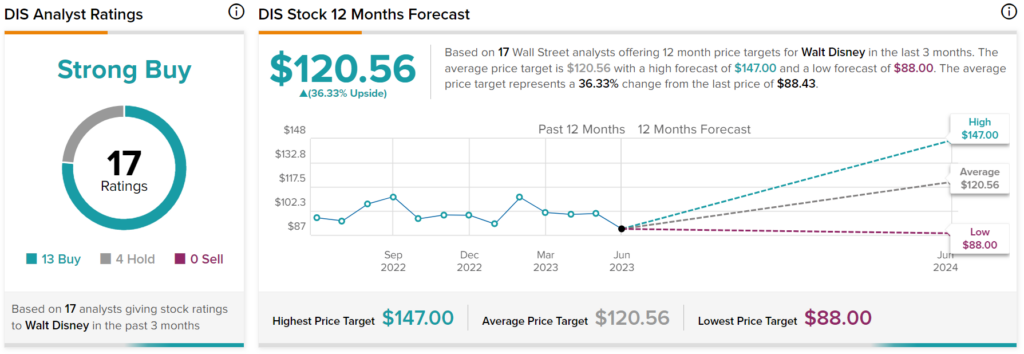

Overall, analysts have a Strong Buy consensus rating on DIS stock based on 13 Buys, four Holds, and zero Sells assigned in the past three months, as indicated by the graphic above. Furthermore, the average price target of $120.56 per share implies 36.33% upside potential.