Disney stock (DIS) dropped after its streaming empire ran into turbulence in September when the company briefly suspended “Jimmy Kimmel Live!” over comments related to a high-profile shooting. The move sparked swift backlash from viewers and celebrities alike, leading to a wave of subscription cancellations across both Disney+ and Hulu.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Data from analytics firm Antenna show churn rates for both platforms doubled from August levels, a rare and sudden shift that underscores how quickly cultural flashpoints can ripple through subscriber numbers.

Disney Churns Subscribers at Record Pace

Disney+ cancellations jumped to 8% in September from 4% in August. Hulu cancellations rose to 10% from 5%. Antenna calculates churn by dividing monthly cancellations by the prior month’s subscriber base. The result shows a sharp shift in customer behavior during the week the show went dark.

Moreover, the totals were large in absolute terms. Antenna estimated 3 million cancellations for Disney+ and 4.1 million for Hulu. Both figures ran well above the trailing three-month averages. The gap suggests a clear reaction to the Kimmel decision rather than routine seasonal churn.

Disney Suspends Kimmel and Triggers a Backlash

Disney took “Jimmy Kimmel Live!” off the air on Sept. 17 after comments Kimmel made following the fatal shooting of conservative activist Charlie Kirk. The move drew swift attention from regulators and affiliates. FCC Chairman Brendan Carr suggested on a podcast that the agency might act against broadcasters that failed to respond. Some ABC station owners, including Nexstar (NXST) and Sinclair (SBGI), told the network they would drop the show.

Celebrities amplified the backlash. Cynthia Nixon and Howard Stern said they were canceling Disney+. Nixon urged followers, “Cancel your subscriptions to Disney+, Hulu & ESPN now.” Moreover, online calls to cancel gathered momentum through the week, giving the churn numbers a persuasive narrative tailwind.

Disney Reinstates Kimmel and Recovers Viewers

Disney restored the show on Sept. 23, and the return drew 6 million viewers, far above the second-quarter average of 1.8 million. This rebound hinted at pent-up demand and the drawing power of a fast-moving news cycle.

Moreover, Nexstar and Sinclair returned the show to their stations shortly after Disney put Kimmel back on air. The quick affiliate turnaround eased distribution risk and helped steady the late-night lineup. The episode still left a mark. It showed how quickly an on-air decision can spill into subscriber behavior.

Disney Adds Subscribers Even as Churn Stays High

Even as cancellations rose, sign-ups for Disney+ and Hulu increased in September compared with August. The lift suggests that the library and new releases continued to attract viewers. It also shows how a strong brand can add gross additions while losing more users than usual on the back end.

Moreover, Antenna’s figures exclude some subscribers who get access through third-party bundles such as wireless carriers. That caveat means the full picture may be more complex across distribution partners. Still, the measured spike in churn is clear enough to matter for near-term metrics.

Disney Raises Prices and Tests Viewer Loyalty

Disney plans to increase streaming prices starting Oct. 21. The timing lands close to a month when cancellations already ran hot. Pricing power will now be tested against the loyalty shock that followed the suspension and return.

Moreover, the company will look for the net effect. Higher average revenue per user can offset churn if gross adds stay healthy and downgrades remain limited. If cancellations remain elevated, the equation gets harder. The balance between price, product, and controversy becomes the story.

Is Disney Stock a Good Buy?

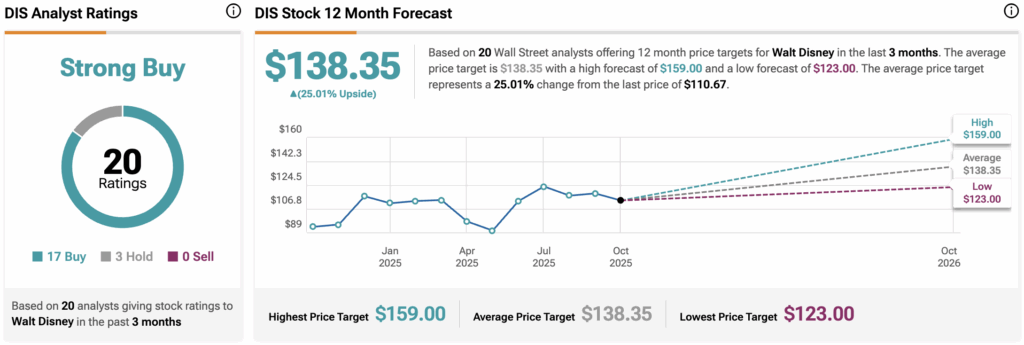

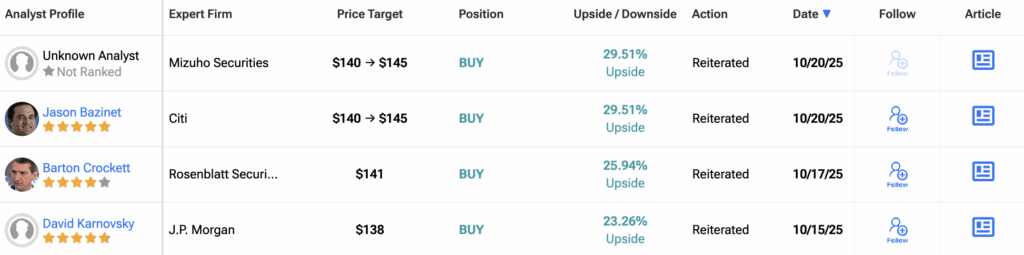

Turning to Wall Street, analysts have a Strong Buy consensus rating on DIS stock based on 17 Buys and three Holds assigned in the past three months, as indicated by the graphic below. After a 14.54% rally in its share price over the past year, the average DIS price target of $138.35 per share implies 25% upside potential.